Gemini’s Retrenchment Strategy: Can Cost Discipline and Prediction Markets Reset the Exchange’s Economics?

Gemini’s decision to exit multiple overseas markets and reduce headcount marks one of the clearest strategic resets among large US-based crypto exchanges since the last market cycle. After years of geographic expansion, heavy compliance spending, and uneven revenue tied to spot trading volatility, the Winklevoss-founded exchange is narrowing its focus to a smaller number of jurisdictions where regulatory clarity and institutional demand are perceived to be stronger.

Analysts at Mizuho believe the move could finally begin to repair Gemini’s margin profile later this year, as restructuring charges roll off and operating expenses normalize. More importantly, they argue that Gemini’s long-term value will depend less on retail spot volumes and more on newer business lines such as prediction markets and institutional custody.

The question for investors is whether this reset represents a temporary defensive maneuver—or the beginning of a structurally different Gemini.

From Expansion to Retrenchment

Over the past several years, Gemini pursued a familiar crypto-exchange playbook: expand internationally, build compliance infrastructure across multiple jurisdictions, and position itself as a regulated alternative to offshore competitors. That strategy delivered credibility, but it came at a cost.

Operating in the UK, the European Union, and Australia required parallel licensing efforts, localized compliance teams, and product adjustments that did not always translate into proportional revenue. As crypto trading activity cooled and fee compression intensified, those fixed costs became increasingly difficult to justify.

Gemini’s announcement that it will wind down operations in those regions while cutting roughly 25% of its workforce is a tacit acknowledgment that the previous growth model was misaligned with current market realities. Rather than chasing global footprint for its own sake, the exchange is prioritizing markets where it believes regulatory rules are clearer and institutional participation is deeper.

According to Mizuho analysts Dan Dolev and Alexander Jenkins, this shift is “margin-accretive.” In other words, Gemini is trading top-line optionality for cost discipline and operating leverage.

Short-Term Pain, Medium-Term Leverage

The restructuring is expected to result in approximately $11 million in charges in the first quarter, a non-trivial sum for a company whose profitability has been a persistent concern. However, Mizuho expects those expenses to fade later in the year, setting the stage for margin improvement into 2026.

This dynamic is familiar to investors in traditional fintech and brokerage firms. When expansion slows and cost bases reset, operating leverage can improve quickly if revenue stabilizes. For Gemini, the key variable is whether it can replace volatile spot-trading income with businesses that are less sensitive to crypto market cycles.

That is where prediction markets and institutional custody enter the picture.

Prediction Markets as a Strategic Pivot

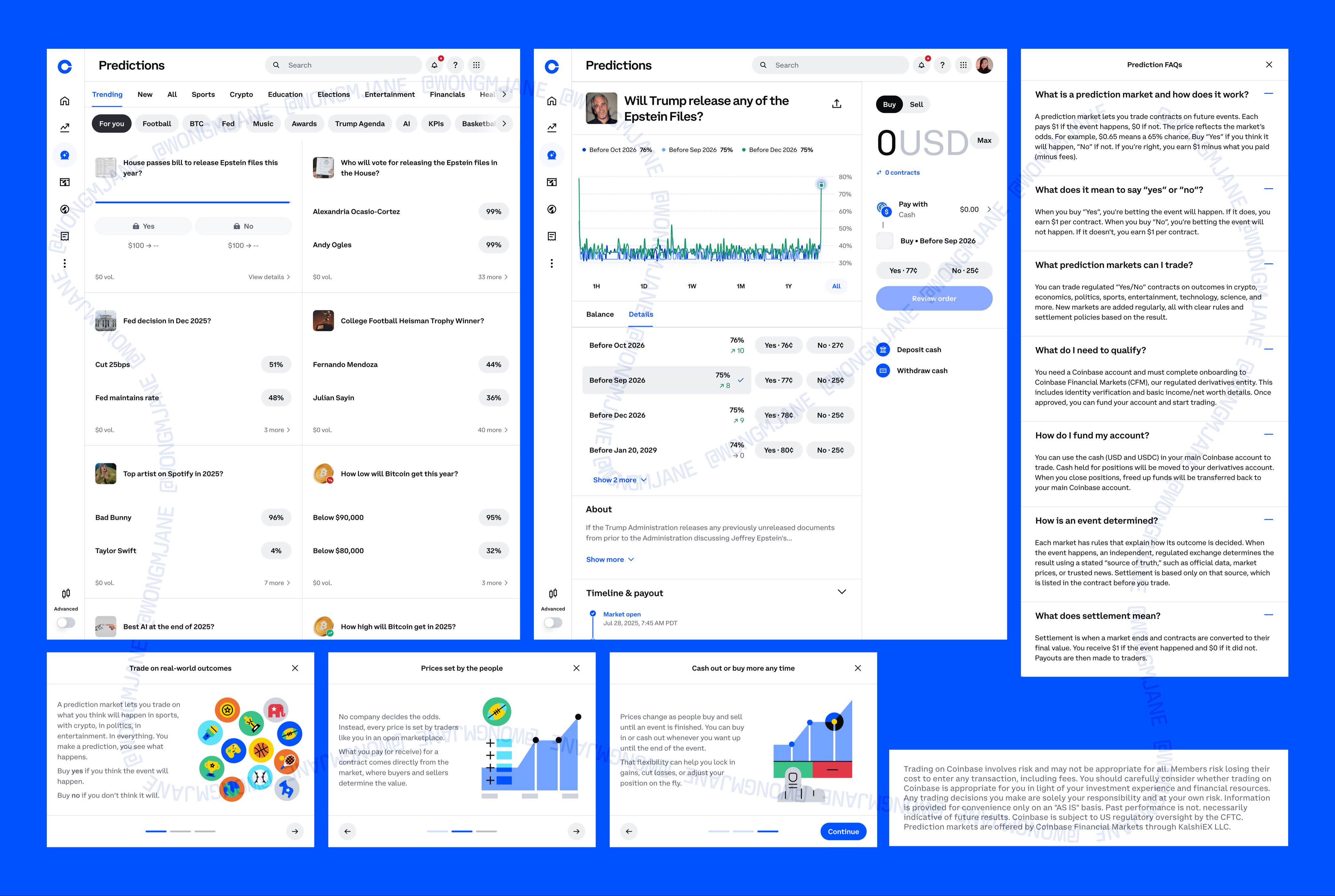

Gemini’s receipt of approval from the Commodity Futures Trading Commission to launch regulated prediction markets in the United States represents more than a product launch. It signals a strategic bet on event-driven trading as a new revenue stream that can coexist with, rather than depend on, spot crypto volumes.

Prediction markets offer several characteristics that appeal to exchanges under pressure:

- High engagement without requiring large balance-sheet exposure

- Frequent contract resolution, driving transaction activity

- Demand tied to real-world events rather than crypto price trends

For Gemini, regulated prediction markets also fit its long-standing emphasis on compliance and regulatory alignment. Unlike offshore platforms, Gemini can market these products as institutionally acceptable and legally robust within the US framework.

Mizuho sees this business as one of the key levers that could help Gemini stabilize revenue beyond traditional trading cycles. If successful, prediction markets could provide a steadier transaction base during periods when crypto spot volumes decline.

However, this is not a guaranteed win. Prediction markets carry their own risks: user churn, regulatory scrutiny, and questions around long-term customer value. Gemini’s challenge will be to integrate these products without turning the platform into a short-term speculation engine at the expense of durability.

Institutional Custody: A Slower but Stickier Business

Alongside prediction markets, Mizuho highlights institutional custody as another pillar of Gemini’s future economics. Custody is not a high-margin business in isolation, but it is sticky. Once institutions entrust assets to a custodian, switching costs are high.

For Gemini, custody services offer three strategic benefits:

- Recurring revenue less tied to trading volumes

- Institutional relationships that can support additional products

- Regulatory defensibility relative to pure trading platforms

As more traditional asset managers, hedge funds, and corporates explore digital assets, custody becomes foundational infrastructure. Gemini’s early investment in compliance and security positions it to compete in this segment, particularly in the US and Singapore, where institutional frameworks are more defined.

This focus aligns with the broader trend of crypto exchanges evolving into financial infrastructure providers rather than pure trading venues.

Geographic Focus and Regulatory Clarity

By concentrating operations in the US and Singapore, Gemini is effectively choosing predictability over optionality. Both jurisdictions offer clearer licensing regimes and stronger institutional participation than many other markets.

This does not mean those markets are easy. The US regulatory environment remains fragmented, and compliance costs are high. But clarity, even when restrictive, allows firms to plan capital allocation and product development more effectively.

In contrast, operating across multiple jurisdictions with evolving or ambiguous crypto rules often forces exchanges into reactive compliance spending, eroding margins without delivering commensurate growth.

Mizuho argues that redeploying compliance and operational resources into fewer markets should improve efficiency. For Gemini, this also reduces managerial complexity at a time when focus matters.

Stock Performance and Investor Skepticism

Despite Mizuho’s optimistic outlook, the market remains unconvinced. Shares of Gemini Space Station Inc. (NASDAQ: GEMI) recently traded near $7.60 after hitting an all-time low of $6.35, reflecting broader weakness in crypto-related equities.

Exchange stocks have struggled as investors reassess the sustainability of crypto trading revenue. Fee compression, competition from decentralized platforms, and regulatory uncertainty have all weighed on valuations.

Mizuho’s reiterated Outperform rating and $26 price target stand in stark contrast to current sentiment. The firm even outlines a bull-case scenario in which faster user growth and a quicker return to profitability could push shares toward $43.

That scenario assumes more than cost cuts. It assumes Gemini can successfully execute its strategic pivot.

Exchange Sentiment Remains Divided

Mizuho’s survey data suggests that investor views on crypto exchanges are increasingly bifurcated. While fintech stocks are generally favored for 2026, crypto-native platforms are seen as either potential winners or structural laggards, with little middle ground.

This reflects a broader reassessment of the sector. Investors are no longer rewarding growth at any cost. They are looking for evidence of sustainable business models, diversified revenue, and operating discipline.

Gemini’s restructuring addresses one of the most consistent criticisms leveled at the firm: its inability to translate regulatory credibility into profitability. Whether that criticism fades will depend on execution, not announcements.

Prediction Markets and the Risk of Misalignment

While Mizuho is constructive on prediction markets, the broader industry debate is more cautious. Event-driven trading can generate revenue, but it can also accelerate user churn if losses accumulate quickly.

Gemini’s advantage lies in its regulatory posture. By offering prediction markets within a compliant framework, it can potentially attract users who would not engage with offshore platforms. The challenge will be balancing engagement with long-term customer value.

If prediction markets become a core growth driver, Gemini will need to ensure they complement, rather than cannibalize, its broader financial relationship with users.

A Reset, Not a Resolution

Gemini’s exit from multiple overseas markets and its workforce reduction should be understood as a reset rather than a resolution. The company is buying itself time and flexibility by lowering its cost base and narrowing its focus.

Mizuho’s thesis is that this reset creates the conditions for margin improvement and operating leverage, particularly as restructuring costs fade. Prediction markets and institutional custody are positioned as the next engines of stability.

But the underlying structural challenges remain:

- Intense competition among exchanges

- Regulatory uncertainty, especially in the US

- Cyclical trading volumes

- Evolving user behavior

Gemini’s future will depend on whether it can transform from a compliance-heavy trading venue into a diversified financial platform with recurring, defensible revenue streams.

What the Market Will Watch Next

Over the next 12–18 months, several indicators will determine whether Mizuho’s optimism is justified:

- Evidence that operating expenses decline meaningfully after restructuring

- Uptake and revenue contribution from prediction markets

- Growth in institutional custody assets

- Stabilization or improvement in user metrics

- Progress toward consistent profitability

Absent those signals, cost cuts alone will not be enough to change the narrative.

Conclusion: A Narrower Path, but a Clearer One

Gemini’s retrenchment reflects a broader maturation across the crypto exchange sector. The era of unchecked expansion is giving way to a more disciplined phase focused on margins, regulatory clarity, and product relevance.

Mizuho’s view is that Gemini is finally aligning its cost structure with its strategic strengths. By concentrating on the US and Singapore, and by investing in prediction markets and institutional custody, the exchange is narrowing its path—but also making it clearer.

Whether that path leads to sustained profitability remains uncertain. What is clear is that Gemini’s future will be defined less by how many markets it operates in, and more by how effectively it can convert regulatory credibility into durable economics.

[…] is what people miss when they talk about prediction markets like they’re just nerdy election toys. In a permissionless environment, “belief” isn’t a […]