US Crypto Market Structure Bill Stalls: Senate Gridlock, Stablecoin Fights, and Election-Year Politics

Washington was supposed to deliver crypto clarity this year. Instead, it delivered gridlock. What started as a bipartisan push to draw clean lines around digital asset markets is now stuck…

OANDA’s Exit From Proprietary Trading: Strategic Retreat or Regulatory Discipline?

Hybrid broker-prop models were always going to face a reckoning. This week, OANDA made its choice. Starting March 2, 2026, OANDA Prop Trader accounts begin migrating to FTMO Group’s standalone…

Six Polymarket Wallets Earn $1.2M on Iran Strike Prediction

Prediction markets love calling themselves truth engines. Prices as probability. Collective intelligence distilled into a number. Then six wallets turned roughly $1 million into $1.2 million betting the United States…

Polymarket Prices a 6% Chance of ‘Bill Gates Charged by June 30’

A new Polymarket contract asking whether Bill Gates will be formally charged or indicted in the US by June 30, 2026 is trading around 6% “Yes.” Six percent. That sounds…

Kalshi Suspends MrBeast Editor in Insider Trading Case, Fines Total $22,000

Prediction markets like to say they’re not casinos. They’re exchanges. Information markets. Probabilities with price discovery. This week, Kalshi tried to prove it — not with a marketing campaign, but…

Senate Reopens Binance Scrutiny Just Two Years After $4B Guilty Plea

Two years after Binance wrote a $4 billion check and called it a reset, Washington is back at the door. Not with a new indictment. Not with a splashy DOJ…

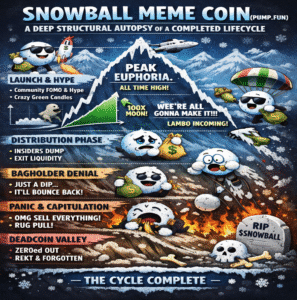

From $10 to $0.0005: The Treasury Shock Behind Step Finance’s Collapse

The collapse of Step Finance wasn’t a slow bleed. It was a treasury shock. Then silence. No regulatory crackdown. No gradual user exodus. No drawn-out governance drama. Just a $40…

ABCeX, Exmo, Rapira, Aifory, and Bitpapa Helped Russia Move $11 Billion Despite Crypto Sanctions

Elliptic didn’t just publish another compliance memo. It dropped a map. And the picture isn’t flattering for regulators. Since 2022, Western sanctions have tried to choke off Russia-linked crypto channels.…

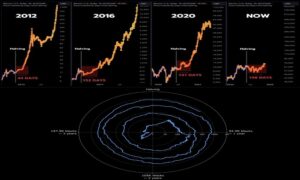

A 4.3% Bitcoin Move Could Liquidate $600M in Shorts

Bitcoin looks boring right now. That’s the trap. Price has been drifting between roughly $65,900 and $70,500. No fireworks. No dramatic breakdown. Volatility has tightened. Momentum indicators are flat enough…

Polymarket Ordered to Halt Dutch Operations: What the Netherlands Crackdown Signals for Global Prediction Markets

Polymarket just ran into a wall in the Netherlands. Not a warning shot. Not a polite letter. A hard stop. The Dutch Gambling Authority ordered Polymarket’s Dutch-facing entity, Adventure One,…