How Scarcity Is Being Repriced in 2026: Bitcoin, Gold, and Silver in a Financialized World

By 2026, scarcity has stopped behaving like a static property and started functioning more like a variable shaped by access, narrative, and financial infrastructure. Markets no longer price scarcity purely…

CFTC Clears Bitnomial for Prediction Markets, Marking a Turning Point for US Crypto Regulation

The US regulatory stance toward prediction markets quietly but decisively shifted this week. With the issuance of a no-action letter to Bitnomial, the Commodity Futures Trading Commission (CFTC) signaled a…

Moo Deng Memecoin Trades Near $82M After Extended pump.fun Expansion

Moo Deng, a Solana-based memecoin listed on pump.fun, is trading around a $81.8 million market capitalization, stabilizing after an extended period of volatility that followed its initial expansion phase. The…

Fartcoin Memecoin Holds Above $400M as pump.fun Listing Shows Renewed Strength

Fartcoin, a Solana-based memecoin listed on pump.fun, is trading around a $413.6 million market capitalization, stabilizing after a long consolidation phase that followed its prior cycle peak near $2.6 billion.…

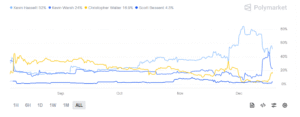

Polymarket and Dow Jones Bring Prediction Markets Into the Financial Mainstream

Prediction markets have spent most of their existence at the edge of finance—used by niche communities, debated by academics, and often dismissed by regulators as little more than speculative curiosities.…

Polymarket’s Quiet Fee Shift Signals a Structural Turning Point for Prediction Markets

Prediction markets have spent much of their crypto-native existence defined by one feature above all else: zero fees. The absence of explicit trading costs was not just a pricing choice,…

Real Estate Enters Prediction Markets as Parcl and Polymarket Redraw the Boundary

Prediction markets are steadily expanding beyond politics, sports, and crypto-native price forecasts into domains traditionally dominated by economists, policymakers, and long-term investors. The partnership between Parcl and Polymarket marks one…

The Most Active Blockchains of 2026: What Transaction Volume Really Tells Us

Transaction counts are one of the most cited — and most misunderstood — metrics in crypto. They are easy to compare, visually compelling, and often used as shorthand for “adoption.”…

Bitcoin Whale Accumulation: Why the Narrative May Be Misleading

Speculation that Bitcoin “whales” are quietly reaccumulating ahead of another major leg higher has become one of the most persistent narratives in recent months. Across social media and trading desks,…

Will the Fed Move in January 2026? Polymarket Prices a Near-Certain Hold

Prediction markets have become a real-time scoreboard for macro expectations, often distilling thousands of pages of economic data and central bank commentary into a single probability curve. One of the…