Token Snapshot

- Token: TikTok supercycle

- Platform: pump.fun (Solana)

- Market Cap: ~$6.4K (ATH ~$7.0K)

- Age: Minutes

- Bonding Curve Progress: ~23%

- Volume (initial): ~$580

- Creator Rewards Distribution: 100% to creator

- Admin Wallet Balance: ~$551

Interpretation: Very early-stage, pre-graduation, price discovery just started.

1) On-Chain Fundamentals

What we can infer visually:

- Holder count: Extremely low (early mint phase)

- Ownership concentration: Very high (creator controls majority by design)

- Transfers: Minimal, clustered in launch window

Assessment:

- 🟥 Holder distribution (expected but still risky)

- No decentralization yet

- This is not a “holder play” stage—pure launch dynamics

2) Liquidity Analysis

Key points:

- Liquidity is bonding-curve based, not yet graduated

- No external DEX liquidity pool

- Liquidity cannot be considered “locked” yet

- Exit liquidity depends entirely on new buyers

Assessment:

- 🟥 Liquidity maturity

- Until graduation, exit risk is structurally high

- Acceptable only for very small speculative sizing

3) Volume & Price Structure

Observed behavior:

- Single vertical impulse to ~$6.8K–$7K

- Immediate stall and retrace

- No base formation yet

- Volume spike without follow-through

Interpretation:

- Classic launch spike, not trend confirmation

- Needs:

- Higher lows

- Repeated buys at similar MC

- Slower, stepwise progression

Assessment:

- 🟥 Volume quality (too thin)

4) Bonding Curve Status

Bonding Curve Progress: ~23%

Meaning:

- Still early, but not brand new

- Early entrants already sitting on paper gains

- Risk of:

- Early wallet selling into next spike

- Momentum exhaustion before graduation

Key level to watch:

- 40%–60% curve progress with rising volume = healthier continuation signal

Assessment:

- 🟨 Curve position (neutral-to-risky)

5) Social & Narrative Check

Narrative:

- “TikTok supercycle” — meme + macro-attention angle

- No description, no roadmap

- Comments are minimal, mixed language, no clear coordination

Interpretation:

- Narrative is recognizable, which helps

- But no visible propagation yet

- No clear social ignition phase

Assessment:

- 🟨 Social engagement (undeveloped)

6) Developer / Creator Signals

Observed:

- Anonymous creator (normal on pump.fun)

- Creator rewards set to 100%

- Creator wallet holds ~$551

Interpretation:

- Incentive skewed toward creator

- No visible commitment signals (site, roadmap, follow-up messaging)

Assessment:

- 🟥 Transparency / alignment

7) Tokenomics Reality

At this stage:

- No burns

- No vesting

- No emissions control beyond bonding curve

This is pure reflexive trading, not token economics.

8) Risk Scorecard (Current State)

| Factor | Risk |

|---|---|

| Holder Distribution | 🟥 |

| Liquidity Maturity | 🟥 |

| Volume Quality | 🟥 |

| Bonding Curve Position | 🟨 |

| Social Engagement | 🟨 |

| Creator Alignment | 🟥 |

Overall Risk Profile: Very High

Final Verdict

This token is:

- A launch-phase speculative micro-cap

- Suitable only for:

- Very small, momentum-based trades

- Quick reaction entries, not holds

- Not suitable for:

- Size

- Holding through inactivity

- Assuming “TikTok narrative” will self-propagate

What Would Improve the Setup

- Bonding curve progress >40% with new volume

- Reclaim and hold above ~$7K MC

- Visible social coordination (Telegram/X burst)

- Slower price action (less vertical, more stair-step)

If you want, I can:

- Track this token through graduation probability scenarios

- Build a pump.fun early-stage probability model

- Compare it against successful TikTok-themed launches

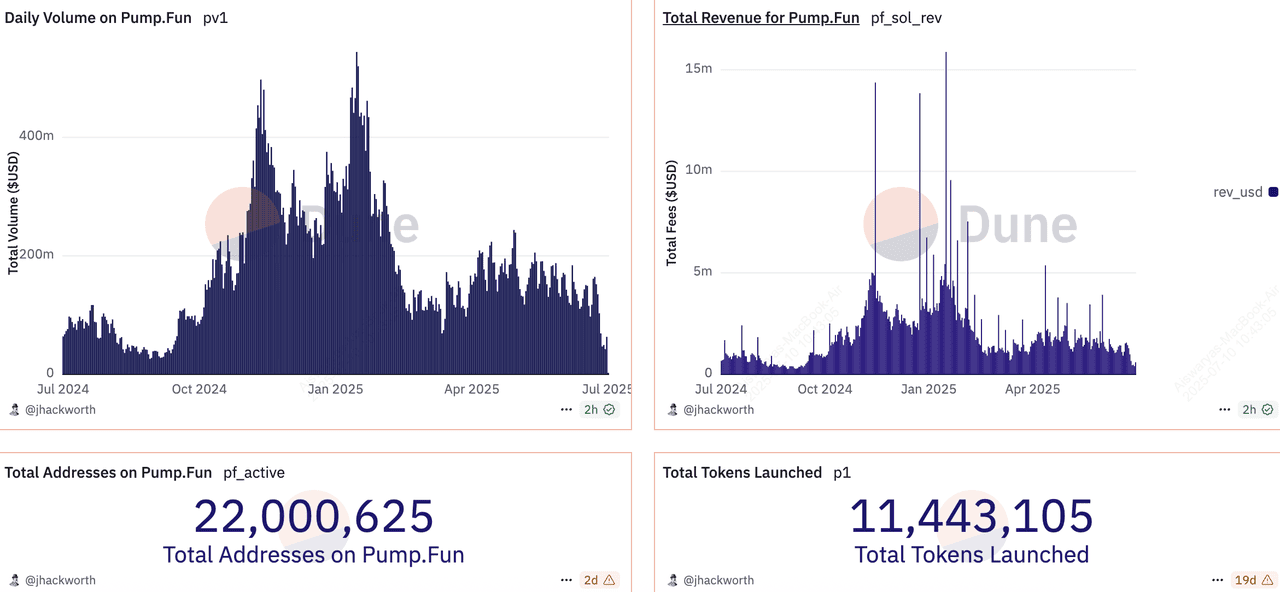

TikTok Supercycle, a newly launched Solana memecoin listed on pump.fun, has entered the earliest stage of price discovery, trading at a market capitalization of roughly $6,400, with a brief peak near $7,000 shortly after launch. The memecoin, which is currently listed on pump.fun and still progressing through the bonding curve, remains firmly in its pre-graduation phase.

As a pump.fun memecoin in its first minutes of trading, TikTok Supercycle is operating under pure launch dynamics. Liquidity is entirely bonding-curve based, ownership remains highly concentrated by design, and price movement is driven almost exclusively by early speculative flows rather than broader market participation.

Initial trading volume is estimated at around $580, with bonding curve progress sitting near 23%, indicating that while the memecoin has moved beyond its first mint transactions, it remains far from graduation. At this stage, TikTok Supercycle reflects a typical early-launch profile for memecoins listed on pump.fun, where structural risk remains extremely high and survival depends on rapid momentum continuation.

The token’s branding references a potential “TikTok supercycle,” attempting to tie social media virality to memecoin speculation. However, at this point, narrative recognition has not yet translated into measurable social coordination or sustained buying pressure.

Deep Structural Analysis: TikTok Supercycle at the Genesis Stage of the pump.fun Lifecycle

Lifecycle Position: Pre-Graduation Genesis Phase

TikTok Supercycle currently sits in the Genesis phase of the memecoin lifecycle. As a pump.fun-listed memecoin that has not yet reached 30% bonding curve progress, it remains fully dependent on incremental new buyers to support price.

At this stage, there is no decentralization, no external liquidity pool, and no structural defense against rapid drawdowns. This is not a failure condition—it is the default state for all pump.fun memecoins at launch—but it places the token in the highest-risk zone of its existence.

On-Chain Fundamentals and Holder Concentration

Visual inspection of the launch data indicates:

-

Extremely low holder count

-

High ownership concentration, with the creator wallet controlling the majority of supply

-

Minimal transfer activity outside the launch window

This structure is expected for a memecoin listed on pump.fun in its earliest phase. However, it also means that no holder base exists yet, and price action cannot be interpreted as market consensus.

At this stage, TikTok Supercycle is not a “holder play.” It is a flow-driven launch asset, where survival depends on sustained participation rather than conviction.

Liquidity Structure and Exit Risk

Liquidity for TikTok Supercycle remains entirely internal to the pump.fun bonding curve. There is no external DEX pool, no locked liquidity, and no graduation event yet.

This has several implications:

-

Exit liquidity depends exclusively on new entrants

-

Any early wallet can materially impact price

-

Slippage risk remains elevated

Until graduation occurs, TikTok Supercycle cannot be evaluated using traditional liquidity metrics. This is a defining characteristic of pump.fun memecoins, not a flaw unique to this token.

Volume and Price Behavior

The initial price action shows:

-

A single vertical impulse toward ~$7,000 market cap

-

Immediate stalling and retracement

-

No visible base formation

This pattern is typical of launch-phase memecoins listed on pump.fun. The first impuls reflects novelty and early curiosity, not trend confirmation. Without follow-through volume and higher-low formation, such moves tend to fade quickly.

For TikTok Supercycle to progress structurally, price action must transition from vertical spikes to stepwise expansion, supportes by repeated buys at similar levels.

Bonding Curve Dynamics

With bonding curve progress around 23%, TikTok Supercycle is in an intermediate launch position:

-

Early enough that upside remains theoretically large

-

Late enough that early entrants already hold paper gains

This creates a fragile equilibrium. If buying pressure accelerates as curve progress approaches the 40%–60% zone, the probability of graduation increases. If not, early holders may sell into the next minor spike, stalling momentum.

The bonding curve itself is not bullish or bearish—it is a pressure amplifier.

Social and Narrative Assessment

The “TikTok supercycle” narrative is recognizable and easy to understand, which is a positive attribute for a memecoin. However, recognizability alone is insufficient.

At present:

-

Social activity appears minimal

-

No visible coordination across comments or platforms

-

No clear identity formation among early participants

For a memecoin listed on pump.fun, narrative ignition must occur quickly. Without visible propagation, even well-named tokens struggle to survive past the first hour.

Developer and Incentive Alignment

Observed creator settings include:

-

Anonymous creator (standard for pump.fun)

-

100% creator rewards distribution

-

Creator wallet balance around ~$551

While this configuration is not unusual, it skews incentives heavily toward the creator and provides no visible alignment signals such as follow-up communication, roadmap hints, or ecosystem framing.

In early-stage pump.fun memecoins, creator behavior in the first few hours often determines survival more than the meme itself.

Desk-Level Summary Analysis

Lifecycle Phase:

Genesis (pre-graduation, bonding curve active).

What Usually Kills Memecoins at This Stage:

Failure to ignite social coordination combined with early wallet sellinf before curve momentum can build. Most pump.fun memecoins die here quietly, not violently.

Primary Structural Risks:

Extreme holder concentration, absence of external liquidity, thin volume, and complete dependence on new buyers for exit liquidity.

Invalidation Signals:

Failure to reclaim and hold above ~$7,000 market capp, stagnation below 30% bonding curve progress, or visible early wallet selling without replacement demand.

What Would Improve Survival Probability:

Bonding curve progress above 40% with rising volumy, repeated higher lows, and clear social propagation tied to the TikTok narrative.

Strategic Interpretation:

TikTok Supercycle is a very early-stage pump.fun memecoin suitable only for small, reaction-based speculation. It is not yet a trend asset, a holder play, or a post-graduation candidate.

*********************************

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, trading, or legal advice. Cryptocurrencies, memecoins, and prediction-market positions are highly speculative and involve significant risk, including the potential loss of all capital.

The analysis presented reflects the author’s opinion at the time of writing and is based on publicly available information, on-chain data, and market observations, which may change without notice. No representation or warranty is made regarding accuracy, completeness, or future performance.

Readers are solely responsible for their investment decisions and should conduct their own independent research and consult a qualified financial professional before engaging in any trading or betting activity. The author and publisher hold no responsibility for any financial losses incurred.