Is the Bitcoin 4-Year Cycle Finally Breaking?

For more than a decade, the crypto market has leaned on a single, powerful mental model: the 4-year cycle. Traders, analysts, miners, and long-term holders built expectations around a familiar rhythm tied to Bitcoin’s halving schedule: a supply shock, an euphoric bull run, a violent correction, then a long reset.

In late 2025, that framework is under visible strain. Spot ETFs have introduced a new, steady path for institutional capital. US regulatory posture is shifting in ways that affect access and risk premia. Global liquidity expectations are moving again. Even a potential Federal Reserve leadership transition has become part of the forward narrative for risk assets, Bitcoin included.

The debate is not academic. If the cycle is ending, stretching, or mutating, the implications land directly on allocation, hedging, and the way investors interpret drawdowns such as Bitcoin’s recent 30% decline from post-halving highs. The more Bitcoin looks like a macro-sensitive asset, the less it behaves like a self-contained, halving-driven island.

Where Did the 4-Year Crypto Cycle Come From?

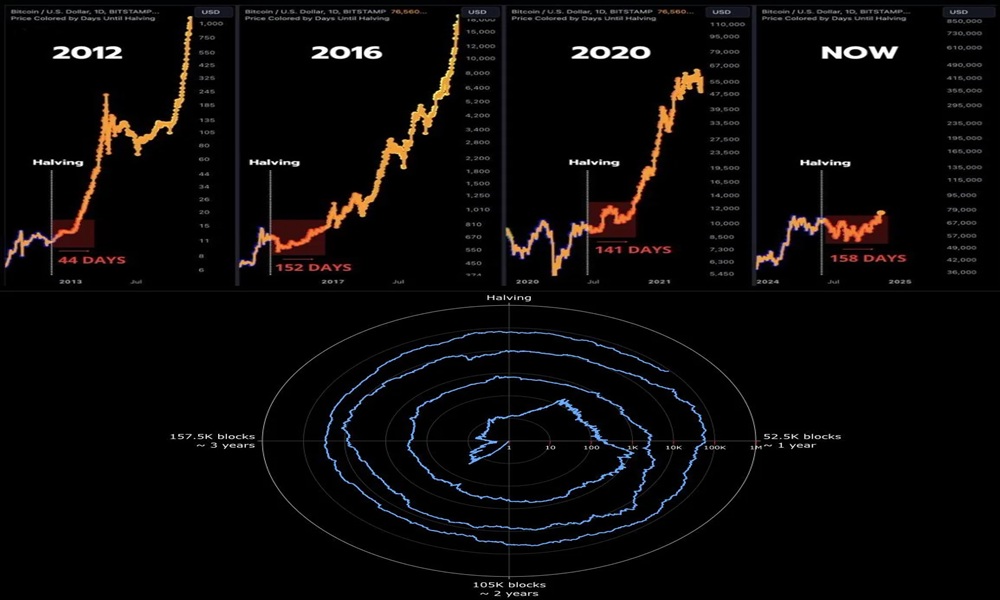

The 4-year cycle is inseparable from Bitcoin’s monetary design. Every 210,000 blocks, the network cuts the block subsidy in half, reducing the flow of new BTC entering circulation. In earlier eras, this recurring supply shock mattered more than it does now because the market was smaller, less liquid, and more reflexive.

From 2012 through 2021, the pattern was consistent enough that it became embedded into crypto culture:

- A halving reduced new supply.

- Accumulation followed as scarcity narratives strengthened.

- A bull market accelerated, often peaking roughly 12–18 months later.

- Leverage and speculative excess triggered a sharp correction.

- A multi-year bear market reset valuations and sentiment.

Importantly, the cycle was never “caused” by halving mechanics alone. It was reinforced by market structure. In earlier cycles, demand was more retail-driven, leverage was often concentrated and poorly risk-managed, liquidity was thinner, and the investor base was more momentum-sensitive. The halving acted as a focal point that coordinated attention, capital, and narrative timing.

Investor Takeaway

The 4-year cycle worked because halving-driven supply shocks interacted with a smaller, retail-heavy, thin-liquidity market. If market structure changes, the same halving can produce a different outcome even if the code stays the same.

Why Are Analysts Saying the Cycle Is Breaking Down?

The strongest version of the “cycle is broken” argument is not that halvings no longer matter. It is that halvings no longer dominate the market’s organizing forces.

Analysts pointing to a regime shift typically cite the same cluster of drivers:

- Spot ETF inflows and institutional participation that smooth demand over time.

- Corporate treasury involvement that behaves differently than retail speculation.

- A shifting US regulatory environment that changes access and risk appetite.

- Macro liquidity cycles that can override internal crypto timing.

In earlier eras, large demand waves often arrived as episodic retail surges. Today, a meaningful share of demand can arrive as programmatic allocations, rebalancing schedules, or mandate-driven positioning. That demand is frequently less sensitive to short-term price moves, which can dampen both blow-off tops and full-scale collapses.

This is why some firms and strategists are increasingly comfortable projecting new highs into 2026 while still acknowledging choppy conditions: they see tailwinds that are structural rather than cycle-timed, including currency debasement dynamics, widening fiscal deficits, and a more accessible market via regulated products.

Investor Takeaway

If institutional demand is steady and rules-based, it can reduce the boom-bust amplitude that once made the cycle obvious. That does not eliminate drawdowns, but it can change their timing, depth, and recovery profile.

How Do Spot ETFs Change Bitcoin’s Market “Physics”?

Spot ETFs matter because they change who buys, how they buy, and how long they hold. Institutional flows tend to look less like a crowd rushing in and out, and more like a slow-moving allocation process. That has several market consequences.

First, ETFs can create a persistent bid during drawdowns. Institutions often accumulate during weakness rather than liquidate into it. Second, portfolio rebalancing can reduce tail risk by forcing systematic trimming after strong rallies and systematic adding after pullbacks. Third, ETF access expands the investor base to participants who either could not custody Bitcoin directly or were unwilling to trade on crypto-native venues.

The result is not “lower volatility forever,” but a different volatility pattern. In earlier cycles, volatility spikes were frequently driven by leverage cascades in crypto-native derivatives markets. Those cascades still exist, but a larger share of demand and holding power can now sit in vehicles designed for long-duration exposure.

This is one reason the cycle debate has intensified after Bitcoin’s post-halving drawdown. In a pure cycle framework, a 30% decline can be read as the beginning of a familiar unwind. In an ETF-driven framework, it can be read as a normal macro-style correction within a structurally supported uptrend.

Investor Takeaway

ETFs can change drawdown behavior by introducing slower-moving, policy-driven capital. Bitcoin can still fall hard, but the marginal buyer and marginal holder are evolving, which can reshape the recovery path.

Is the Fed and Global Liquidity Now the Real Cycle Driver?

Another pillar of the “broken cycle” thesis sits outside crypto: liquidity. Bitcoin’s strongest bull phases have historically aligned with easier financial conditions and rising global liquidity. Its sharpest corrections have often appeared alongside tightening cycles, rising real yields, and stronger funding constraints.

If Bitcoin is increasingly priced as a macro-sensitive asset, then the cadence of its major moves may shift from halving-driven timing to liquidity-driven timing. That means interest rate expectations, fiscal stimulus, and changes in balance sheet policy can matter as much as, or more than, block subsidy adjustments over certain windows.

This is where the idea of a potential Fed leadership transition enters the narrative. Leadership changes do not automatically translate into easier policy, but markets often anticipate regime shifts in reaction function and forward guidance. If investors believe policy could become more accommodative, or that the tolerance for inflation and fiscal dominance is rising, the bid for scarce assets can strengthen across Bitcoin, gold, and certain equity themes.

In that world, “cycles” do not disappear. They become less predictable and less synchronized to a single internal event. Bitcoin may still experience large expansions and contractions, but the trigger points may be macro-driven rather than halving-driven.

Investor Takeaway

If liquidity dominates, Bitcoin’s timing may move from “halving calendar” to “macro calendar.” Investors should track real rates, dollar trends, and financial conditions alongside on-chain and halving variables.

Why Do Some Analysts Think the Classic Cycle Is Still Alive?

Cycle skeptics argue that crypto markets still display the same old fingerprints: post-halving strength, late-cycle leverage, and a meaningful drawdown that shifts sentiment from euphoria to defensiveness. From this view, Bitcoin’s recent decline is less a “healthy correction” and more the opening act of a larger de-risking sequence.

This camp also points out an important historical pattern: declarations that the cycle is dead tend to show up when market participants are most confident that “this time is different.” That is not proof that the cycle must repeat, but it is a warning that narrative certainty can be a contrarian signal.

There is also a structural reason for caution: crypto remains more reflexive than traditional markets. Leverage is still concentrated, funding rates still matter, and liquidation cascades can still reshape price in days. Even with ETFs, the market can experience rapid de-risking, especially if broader risk assets weaken or if funding conditions tighten unexpectedly.

Finally, the halving still changes miner economics and the supply flow. Even if demand is larger and more stable, a supply shock can still matter at the margin, particularly when combined with a bullish macro tape.

Investor Takeaway

The cycle may not be dead; it may be less obvious. Crypto still carries leverage and reflexivity that can produce classic boom-bust behavior, especially if macro conditions turn risk-off.

How Do Expectations and Reflexivity Distort the Cycle?

One underappreciated force in the cycle debate is reflexivity: markets respond to beliefs about markets. When enough participants expect a 4-year rhythm, those expectations can shape flows in ways that either compress or exaggerate the pattern.

If traders anticipate a brutal bear market “on schedule,” they may de-risk early, creating weakness sooner than the historical template would suggest. If investors fear missing the “post-halving melt-up,” they may chase earlier, pulling forward demand and accelerating peaks.

This matters because the cycle’s cultural dominance has effectively turned it into a coordination mechanism. Entire strategies, portfolio timing frameworks, and social narratives have been built around it. When a model becomes widely believed, it can stop describing reality and start influencing reality.

This is why cycle transitions tend to look messy rather than clean. A single, shared framework can persist long after its predictive power weakens, precisely because market behavior is anchored to it.

Investor Takeaway

The more widely the 4-year cycle is believed, the more it can distort flows. Watch behavior, positioning, and liquidity rather than relying on calendar-based certainty.

Why Are Altcoins Not Confirming the “New Cycle” Narrative?

One of the strongest challenges to the “broken cycle” thesis comes from the altcoin market. Bitcoin has benefited most directly from ETF flows and institutional legitimacy. Much of the altcoin complex has not.

In prior cycles, late-stage bull phases often featured broad speculative rotation: profits flowed from Bitcoin to large-cap alts, then to smaller caps as risk appetite expanded. That pattern has been weaker and more fragmented in 2025. Instead of a clean “altseason,” the market has often looked selective, narrative-driven, and intermittently illiquid.

This divergence can be interpreted in 2 different ways. In a bullish interpretation, it reflects capital becoming more disciplined, preferring Bitcoin and high-conviction infrastructure rather than indiscriminate speculation. In a bearish interpretation, it reflects the absence of retail euphoria, suggesting the cycle is incomplete or structurally weaker than prior bull phases.

It also highlights a growing bifurcation inside crypto: Bitcoin is increasingly positioned as macro collateral, while many altcoins remain venture-like risk assets. Those are different instruments with different cycles, even if they share the same headlines.

Investor Takeaway

Bitcoin can shift toward macro behavior while altcoins remain reflexive risk assets. Treat “crypto” as segmented: Bitcoin cycle dynamics may diverge sharply from altcoin cycle dynamics in 2026.

What Does a “Mutated Cycle” Look Like Into 2026?

A realistic middle ground is that the 4-year cycle is not disappearing, but mutating. In this view, halvings still matter, but they are no longer sufficient to explain the full market regime. Instead, Bitcoin’s path becomes a composite of supply mechanics and macro liquidity.

That produces a cycle that can stretch, compress, or fragment:

- Stretched cycle: highs arrive later than the historical template as institutional capital accumulates gradually, extending the upside window into 2026.

- Compressed cycle: peaks arrive earlier because everyone expects the same timeline, pulling forward demand and creating earlier exhaustion.

- Fragmented cycle: Bitcoin behaves macro-like while altcoins follow their own, less predictable risk cycles.

In practical terms, a mutated cycle increases the probability of multiple meaningful drawdowns rather than a single, clean peak-and-collapse sequence. It can also raise the importance of risk controls that are less reliant on “where we are in the cycle” and more reliant on liquidity, positioning, and policy signals.

Investor Takeaway

A mutated cycle usually means more paths and fewer certainties: multiple drawdowns, uneven rotations, and stronger dependence on macro conditions. Adapt risk management from “calendar timing” to “regime tracking.”

How Should Investors Position Around the Cycle Debate?

The most actionable conclusion is not choosing a side, but updating the framework. The old model treated halving-driven timing as the dominant variable. The emerging model treats it as one variable among several.

Investors can translate that into a more durable process:

- Separate Bitcoin from the rest of crypto: Bitcoin’s institutionalization changes its behavior; many altcoins remain venture-like and liquidity-sensitive.

- Track liquidity as a primary input: real rates, dollar trends, credit conditions, and financial conditions can amplify or overwhelm halving effects.

- Watch leverage and positioning: funding rates, open interest, and liquidation risk often determine the violence of drawdowns.

- Respect policy and regulation: access, custody rules, and product approvals can change the demand profile more than narratives do.

- Use scenarios, not certainties: plan for stretched, compressed, and fragmented outcomes instead of assuming the historical script repeats.

From a portfolio perspective, this supports a shift away from all-in timing calls and toward staged exposure, disciplined rebalancing, and clearer drawdown rules. The market may still rhyme with the past, but it is less likely to repeat with the same cadence.

In that sense, the cycle debate is really a maturity debate. As markets grow, their patterns blur under the weight of new products, new participants, and new incentives. Crypto is moving from a single-driver narrative to a multi-factor market. That shift is uncomfortable, but it is also what a maturing asset class looks like.

Investor Takeaway

Do not abandon history, but do not worship it. Use the 4-year cycle as context, then overlay macro liquidity, institutional flow behavior, and leverage indicators to build a more resilient 2026 playbook.

What Are the 3 Most Likely Outcomes for 2026?

Looking ahead, the cycle debate can be reduced to 3 plausible regimes rather than a binary “alive vs dead” argument.

Outcome 1: The stretched cycle. Institutional flows and easier financial conditions extend the post-halving upside window, pushing highs deeper into 2026. Drawdowns still occur, but the market avoids a deep, multi-year winter.

Outcome 2: The classic cycle reasserts itself. The market follows the familiar rhythm: the current drawdown deepens, leverage unwinds further, and crypto enters a longer reset period. ETFs soften the landing but do not prevent it.

Outcome 3: Fragmentation. Bitcoin holds up as a macro asset with structural demand, while altcoins remain weak and episodic. The “crypto market” stops moving as a single organism, forcing investors to treat segments differently.

The practical edge comes from preparing for all 3 rather than betting everything on one story.

Investor Takeaway

The key shift is complexity: 2026 may reward scenario-based positioning more than cycle-based conviction. Build a process that survives multiple regimes instead of relying on one timeline.

[…] cycle. It is a case study in how deeply intertwined individual wealth, corporate strategy, and Bitcoin price dynamics have become as crypto moves further into an institutional, balance-sheet-driven […]

[…] that Bitcoin “whales” are quietly reaccumulating ahead of another major leg higher has become one of the […]