Prediction markets have become a real-time scoreboard for macro expectations, often distilling thousands of pages of economic data and central bank commentary into a single probability curve. One of the most heavily traded macro markets on Polymarket right now asks a familiar but high-stakes question: what will the Federal Reserve do at its January 2026 meeting?

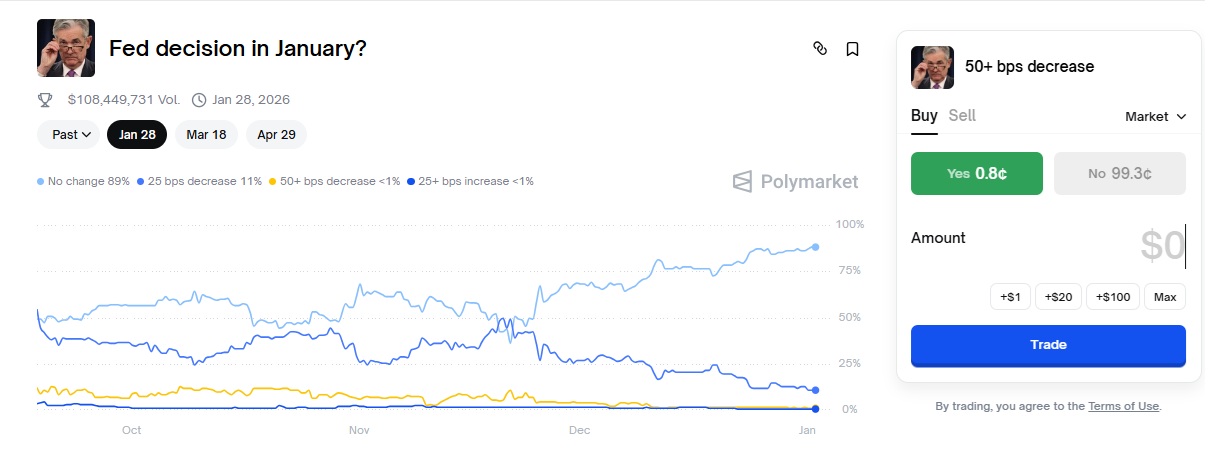

With more than $108 million in total volume, this market ranks among Polymarket’s largest interest-rate contracts. And at first glance, the verdict appears decisive. Traders assign an 89% probability to no change in rates, with just 11% pricing in a 25 basis point cut, and only marginal odds for any larger move or a hike.

Yet, as with most Fed-related markets, the surface-level consensus hides deeper disagreement about timing, signaling, and what the January meeting actually represents in the broader policy cycle.

How This Market Resolves

This contract resolves based on the change in the upper bound of the federal funds target range at the Federal Open Market Committee meeting scheduled for January 27–28, 2026.

If the Fed changes rates by an amount not explicitly listed, the move is rounded to the nearest 25 basis points. If no statement is released by the end of the next scheduled meeting, the market defaults to “No change.” The resolution source is the official FOMC statement published by the Federal Reserve.

In short, this is a clean, binary assessment of what the Fed actually does — not what it signals or hints at.

What the Market Is Pricing

As of now, the probability breakdown looks like this:

-

No change: 89%

-

25 bps decrease: 11%

-

50+ bps decrease: 1%

-

25+ bps increase: <1%

Liquidity is heavily concentrated in the “No change” outcome, which alone has absorbed more than $93 million in volume. The smaller but still meaningful volume on a 25 bps cut — around $8.7 million — suggests that a minority of traders believe January could still mark the start of a renewed easing phase.

The near-zero pricing of hikes or large cuts signals that traders see the Fed’s reaction function as tightly constrained at this stage.

Why “No Change” Dominates

The market’s overwhelming bias toward holding rates reflects several structural realities about January FOMC meetings.

First, January meetings are historically low-probability moments for policy changes, especially when the Fed is still evaluating the impact of previous moves. Even when rate cuts are expected later in the year, the January meeting is often treated as a checkpoint rather than a launchpad.

Second, the Fed’s communication strategy typically favors signaling first, acting later. Traders appear to believe that even if conditions justify easing, the committee would prefer to wait for additional inflation and labor data before committing to a cut.

Third, pricing in external tools like Fed funds futures and rate-watch models has broadly converged on a similar view. While not perfectly aligned, these instruments also suggest that January is more likely to be a pause than a pivot.

The Case for a 25 Basis Point Cut

Despite the dominant consensus, the 11% probability assigned to a 25 bps cut is not trivial. It reflects a coherent alternative scenario rather than pure noise.

Supporters of this view argue that by January 2026, the Fed could face a combination of cooling inflation, slowing growth, and rising political pressure to move earlier rather than later. If inflation continues to trend lower and labor market slack becomes more visible, the Fed may judge that waiting until March or later risks falling behind the curve.

Some traders also point to voting dynamics within the committee. Historical patterns show that certain policymakers have tended to align their votes, which fuels speculation that a majority could coalesce around a modest cut if the data deteriorates quickly enough.

However, the relatively modest volume behind this outcome suggests that even believers see it as a conditional scenario, not a base case.

Why Big Moves Are Off the Table

The market’s near-total rejection of a 50+ bps cut or any rate increase is revealing. Traders appear confident that January 2026 will not be a crisis meeting.

A large cut would typically require either a sharp economic downturn or financial stress severe enough to force the Fed’s hand. At present, there is little in the data or narrative to justify that kind of response. Conversely, a hike would imply that inflation has re-accelerated meaningfully — a scenario that traders are almost entirely dismissing.

This asymmetry underscores how narrowly traders believe the Fed’s policy path is constrained in the near term.

Sentiment Inside the Market

The comments section reflects a familiar divide. Holders of “No change” positions often frame the outcome as inevitable, thanking sellers of cut bets for their losses. Meanwhile, cut-bettors argue that markets routinely misprice Fed decisions until just weeks before the meeting.

One recurring theme is skepticism toward long-dated rate predictions. Several commenters note that Wall Street — and by extension, prediction markets — tends to struggle with accuracy more than a couple of weeks ahead of an FOMC decision.

That skepticism helps explain why the 25 bps cut maintains a non-zero probability despite the apparent consensus.

The Key Variable: Communication vs. Action

A crucial nuance in this market is the distinction between what the Fed says and what it does. January meetings often feature important guidance shifts even when rates remain unchanged.

Traders may be pricing “No change” while still expecting dovish language, updated projections, or signaling that a cut is coming soon. In that sense, the market’s confidence in a hold does not necessarily imply a hawkish stance — only that the Fed is unlikely to pull the trigger immediately.

This distinction matters because markets can react strongly to tone and forecasts even in the absence of a formal rate move.

What Could Move the Odds

Several developments could still meaningfully shift probabilities before the meeting:

-

Unexpected inflation data, especially core measures.

-

Sharp deterioration in labor market indicators.

-

Financial market stress, such as credit spreads widening or equity volatility spiking.

-

Explicit guidance from Fed leadership suggesting earlier action.

Historically, Polymarket odds on Fed decisions tend to compress sharply in the final weeks before resolution, often moving faster than traditional forecasting models.

Bottom Line

Polymarket is currently pricing the January 2026 Fed meeting as a near-certain pause, with a strong consensus around no rate change. That consensus reflects historical patterns, institutional caution, and a belief that the Fed prefers to act later rather than sooner.

However, the presence of a meaningful minority betting on a 25 bps cut highlights ongoing uncertainty about the pace of disinflation and the Fed’s tolerance for waiting. The real debate is not whether rates move in January — but how close the Fed is to its next move, and how clearly it chooses to signal it.

As with most central bank decisions, the final outcome may hinge less on conviction today and more on data that has yet to arrive.

[…] a surface level, the collaboration is straightforward. Polymarket will list and operate contracts tied to movements in housing price indices, while Parcl will […]