Why Do Prediction Markets Trigger Such a Strong Moral Reaction?

Few areas of crypto provoke as visceral a reaction as prediction markets. To critics, they represent a dangerous fusion of speculation and real-world events—markets that monetize catastrophe, undermine democratic processes, and introduce perverse incentives into politics, sports, and even war. To supporters, they are among the most intellectually honest tools finance has ever produced: probabilistic systems that force participants to price reality rather than posture about it.

This divide has sharpened as prediction markets move from the fringes of crypto into mainstream visibility. Legal challenges, regulatory scrutiny, and public condemnation have escalated just as usage has expanded beyond elections into sports, geopolitics, and macroeconomic policy. Into this debate has stepped Vitalik Buterin, who has become one of the industry’s most visible defenders—not by denying the risks, but by questioning whether critics are diagnosing the right problem.

Buterin’s argument is not that prediction markets are harmless. It is that the fears surrounding them are selectively applied, intellectually inconsistent, and often ignore how incentives already operate across financial and media systems. In doing so, he reframes the debate from one about morality to one about comparative risk.

Investor Takeaway

Do Prediction Markets Really Create “Perverse Incentives” To Cause Harm?

At the heart of the criticism is a simple claim: if people can profit from negative outcomes, they may try to cause those outcomes.

This concern intensifies when markets move beyond sports or entertainment and into areas like elections, geopolitics, or public safety. Betting on the collapse of a government, the outcome of a war, or a change in monetary policy feels intuitively different from betting on a football game. Critics argue that once money is attached to such outcomes, the line between observation and manipulation becomes dangerously thin.

The regulatory logic often follows a straightforward chain. If prediction markets resemble betting, they should be regulated like betting. If they risk influencing behavior, they should be constrained. This argument becomes especially forceful when contract categories drift from final outcomes into fuzzier “events” that are easier to manipulate indirectly.

Investor Takeaway

What Is Vitalik Buterin Actually Saying—And Why Is It So Uncomfortable?

Buterin does not dispute the theoretical possibility of harmful incentives. Instead, he questions whether prediction markets meaningfully change the incentive landscape.

His central claim is blunt: the ability to profit from disaster is not unique to prediction markets. It is foundational to modern finance.

In his framing, anyone with sufficient capital can already profit from negative outcomes by shorting stocks, currencies, or entire markets. If a hypothetical political actor had a literal “cause disaster” button, they could press it and profit handsomely through conventional financial instruments. The stock market does not prohibit this logic; it institutionalizes it.

What prediction markets do differently is make these incentives visible, explicit, and quantifiable.

This distinction matters. Critics often frame prediction markets as creating new risks. Buterin frames them as revealing risks that already exist—while stripping away the narrative fog that surrounds other systems. If incentive alignment is the concern, then singling out prediction markets while ignoring equities, credit markets, and derivatives becomes harder to justify.

Investor Takeaway

How Did Elections Push Prediction Markets Into The Mainstream?

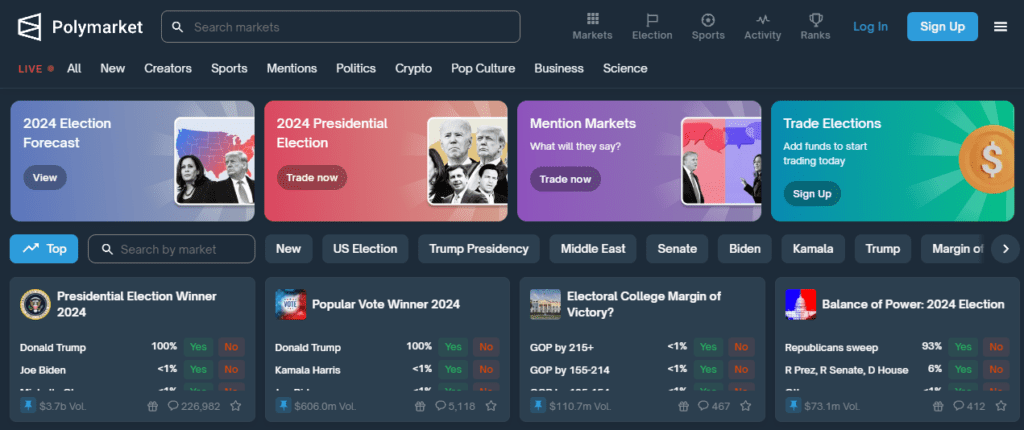

The debate intensified during the 2024 US election cycle, when prediction markets drew large volumes as users bet on presidential outcomes. These markets frequently became cultural reference points, and supporters argued they produced cleaner signals than polling narratives because participants had to stake capital rather than opinions.

Whether or not one accepts the “markets are more accurate” claim, the election cycle changed perception. Prediction markets were no longer a niche crypto curiosity. They became a mainstream information product—one that politicians, journalists, traders, and online communities watched in real time.

In hype-economics terms, the market itself became content. Screenshots of changing odds circulated like headlines. The price was not merely information; it was a narrative object.

Investor Takeaway

Why Are Sports Contracts Becoming the Real Flashpoint?

Since the election cycle, usage has broadened dramatically. Sports-related contracts have become a major driver of volume, which has attracted a new class of critics: leagues, broadcasters, and lawmakers focused on contest integrity.

The most contentious contracts are not simple “who wins the game” markets. The controversy increases when markets move toward in-game events, officiating-adjacent outcomes, and media-driven triggers, such as whether specific terms will be referenced during broadcast coverage.

This is where the incentive critique becomes more credible. Prediction markets’ flexibility is both their strength and their weakness. Without carefully defined boundaries, they can incentivize attention-seeking behavior in ways that traditional sportsbooks often restrict by design. In other words, the market’s ability to price “anything” becomes a governance problem.

Investor Takeaway

Are Geopolitical Markets A Genuine Threat Or Mostly Symbolic Outrage?

The most emotionally charged criticism centers on geopolitical markets. Users can wager on events like leadership changes, policy shifts, and macroeconomic outcomes. Critics argue that such markets trivialize suffering and risk influencing decisions, especially if officials or connected actors could profit from outcomes.

Buterin rejects this framing as speculative and exaggerated. He has stated clearly that he opposes markets tied directly to assassination or violence. At the same time, he argues that the marginal incentive created by prediction markets is small relative to existing political, ideological, and economic motivations.

Wars are not started because traders placed bets. Monetary policy is not set to settle event contracts. These decisions are driven by institutional forces far larger than any prediction market. The fear, in this view, reflects discomfort with explicit pricing of probabilities rather than genuine causal risk.

Investor Takeaway

Can Prediction Markets Actually Reduce Misinformation?

One of Buterin’s most compelling arguments reframes prediction markets not as sources of manipulation, but as counterweights to misinformation.

On social platforms, commentators face asymmetric incentives. Outrage, fear, and sensationalism drive engagement. A pundit who predicts catastrophe faces limited downside if they are wrong; attention has already been captured. The cost of misinformation is diffused across audiences.

Prediction markets invert that incentive. Participants must back claims with capital. Being wrong is expensive. Over time, this can filter out bluster and reward informed consensus—at least in markets with sufficient liquidity, diverse participation, and resistance to manipulation.

Buterin has described scenarios where alarming headlines triggered anxiety while market prices suggested far lower probabilities of extreme outcomes. In those moments, markets provided context rather than panic. The argument is not that markets are perfect truth machines, but that they impose costs on overconfidence in a way media ecosystems often do not.

Investor Takeaway

What Is The Regulatory Problem Regulators Cannot Solve Cleanly?

Regulators face a genuine dilemma: prediction markets do not fit neatly into existing categories. They resemble gambling in form, derivatives in function, and media in impact.

Classifying them as gambling simplifies enforcement but ignores informational value. Treating them as derivatives acknowledges financial structure but raises questions about moral boundaries and contract eligibility. Attempts to regulate based on offensiveness rather than demonstrable harm also risk looking like moral legislation rather than risk management.

At the same time, leaving prediction markets unregulated is not credible. Market manipulation, insider knowledge, conflicts of interest, and contract design failures become more consequential as volumes grow and participants become more sophisticated.

The most workable approach is constraint rather than prohibition: limiting contract categories, position sizing, leverage, and market design features that increase manipulation risk, while preserving contracts that serve legitimate forecasting or hedging demand.

Investor Takeaway

What Do We Trust More: Probabilities or Narratives?

Stripped of rhetoric, the debate over prediction markets is a debate about epistemology.

Do we trust crowds with money on the line more than pundits with platforms? Do we prefer explicit probabilities to implicit narratives? Are we more comfortable with markets that price uncertainty, or with institutions that obscure it?

Prediction markets make uncertainty uncomfortable because they expose it numerically. A 4% probability of disaster is not comforting to those who prefer certainty, but it can be more honest than alarmist headlines or unfalsifiable predictions.

Buterin’s defense rests on this premise. Prediction markets do not eliminate risk. They quantify it. In a world saturated with performative outrage, that function may be more valuable than critics are willing to admit.

Investor Takeaway

Where Are the Real Risks—and How Do Markets Break?

None of this suggests prediction markets are benign by default. Poorly designed markets can amplify noise, invite manipulation, or cross ethical lines. Sports contracts tied to soft, influenceable triggers raise legitimate integrity concerns. Markets tied directly to violence demand careful exclusion and principled enforcement.

The central risk is not that prediction markets exist, but that they expand without coherent constraints. A permissive “list everything” approach invites regulatory confrontation and reputational damage, even if the market impact is small.

Yet banning prediction markets outright would not remove the underlying incentives critics fear. It would merely push speculation back into less transparent systems—stocks, derivatives, and media narratives—where accountability is weaker and incentives are harder to see.

Investor Takeaway

Conclusion: Moral Panic vs Comparative Risk

Prediction markets challenge deeply held assumptions about how society processes information. They force uncomfortable questions about incentives that already permeate finance and media.

Vitalik Buterin’s defense does not claim prediction markets are perfect. It claims the outrage surrounding them is misdirected. If society tolerates financial systems that allow profit from catastrophe, and media systems that reward fear, then singling out prediction markets looks less like risk management and more like moral panic.

As regulators, platforms, and users grapple with this frontier, the choice is not between purity and corruption. It is between explicit, accountable probabilities and implicit, unpriced narratives. In that choice, prediction markets may be less dangerous—and more honest—than their critics assume.

[…] was not a protocol-level failure, nor was it a smart contract exploit. It appears to be a client-side compromise tied to a specific […]

[…] associated only with major sportsbooks. Yet the more consequential transformation was qualitative. Prediction markets stopped behaving like speculative novelties and began operating as financial […]