Market Overview

-

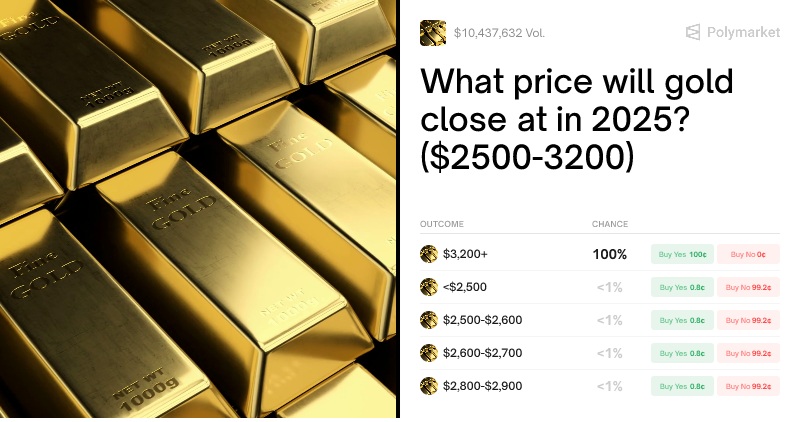

Platform: Polymarket

-

Question: “What will Gold (GC) hit by end of February?”

-

Resolution date: February 28, 2026

-

Total volume: ~$3.1M

-

Structure: Price ladder (multiple mutually exclusive ranges)

This is effectively a crowd-built probability distribution for where gold tops out by month-end.

1) How to Read This Market (Critical)

Each row is not directional bias — it’s a cap hit probability.

Example:

-

“↑ $5,500 – 36%” means:

the market assigns a 36% chance that gold touches $5,500 at least once before Feb 28.

It does not mean:

-

Gold ends at $5,500

-

Gold stays above $5,500

This is a maximum-print market, not a closing-price market.

2) The Probability Distribution Shape

From the screenshot, probabilities cluster around:

-

$5,500 → ~36%

-

$4,600 → ~50%

-

$4,450 → ~32%

-

Upper extremes:

-

$6,000 → ~10%

-

$6,600+ → low single digits

-

$10,000 → ~1%

-

Lower tail:

-

$4,000 → ~9%

-

$3,600 → ~4%

-

$3,000 → ~2%

This forms a classic bell-shaped crowd distribution centered roughly in the $4,500–$5,500 zone.

3) What the Market Is Actually Saying

Stripped of noise, the crowd believes:

-

A substantial pullback below $4,200 is unlikely

-

A blow-off above $6,000 is possible but low probability

-

The modal expectation is:

-

Strong volatility

-

Wide range

-

No extreme breakout yet

-

This is not a euphoric gold market, despite bullish long-term narratives.

4) Why Upper Tails Are Cheap

Even though gold bulls talk about $6,000–$10,000:

-

Polymarket traders price time constraints very aggressively

-

February is too short for regime-change pricing

-

Parabolic moves require:

-

Monetary shock

-

Sovereign default

-

Sudden war escalation

-

Absent that, tails stay cheap.

This is why:

-

$10,000 is priced at ~1%

-

$7,000 at ~2%

That doesn’t mean “impossible” — it means no visible catalyst yet.

5) Volume Concentration = Conviction

Notice where volume clusters most heavily:

-

$4,600

-

$5,500

-

$5,800

That tells you:

-

Traders are actively debating the mid-range

-

Not chasing moonshots

-

Not hedging disaster scenarios aggressively

This is range-volatility consensus, not trend conviction.

6) Comparison to Gold Futures Psychology

This ladder lines up with classic GC behavior:

-

Gold tends to:

-

Spike intraday

-

Print extremes

-

Retrace violently

-

Prediction markets price “touch risk”, not trend comfort.

So a 36–50% chance of $4,600–$5,500 does not imply confidence — it implies expected turbulence.

7) Is This Market Efficient?

Yes — unusually so.

Signs of efficiency:

-

Smooth probability curve

-

No obvious mispriced step

-

No panic compression at the top

-

No fear clustering at the bottom

That suggests:

-

No obvious arbitrage

-

No headline distortion

-

This market is being traded by macro-aware participants, not tourists

Final Take

This Polymarket ladder says:

-

The crowd expects big swings

-

But no February regime break

-

Gold is treated as a volatile hedge, not a runaway asset (yet)

In short:

“High volatility, wide range, no moon — for now.”

A high-volume market on Polymarket asking “What will Gold (GC) hit by the end of February?” is quietly offering one of the clearest real-time reads on how traders actually see gold behaving over the next few weeks.

With roughly $3.1 million in volume and a ladder of mutually exclusive price levels, this isn’t a directional bet on where gold closes the month. It’s something more useful: a crowd-built probability distribution for how high gold is likely to trade at any point before February 28.

In other words, this market isn’t about conviction. It’s about volatility.

How This Market Actually Works (And Why Most People Misread It)

Each row in the ladder represents the probability that gold touches a given level at least once before month-end.

So when you see:

-

$5,500 at ~36%,

that doesn’t mean gold ends February at $5,500.

It means there’s a 36% chance gold prints that level at any moment before the clock runs out.

This is a maximum-print market, not a closing-price forecast. And that distinction changes everything.

The Shape of the Curve Tells the Story

The probabilities form a very clean distribution:

-

Heavy clustering between $4,500 and $5,500

-

A noticeable peak around the mid-$4,000s

-

Rapid drop-off above $6,000

-

Thin but non-zero tails on the downside

That’s not euphoria. That’s expectation of wide swings without regime change.

If traders believed gold was about to enter a runaway phase, the upper rungs would be bid aggressively. They aren’t.

What the Crowd Is Really Saying

Strip away the numbers and the message is simple:

-

A sharp collapse below $4,000 looks unlikely

-

A blow-off move above $6,000 is possible, but not the base case

-

The most likely outcome is violent range trading, not a clean trend

This is how gold gets priced when it’s being treated as a hedge with nerves, not a one-way macro trade.

There’s fear here. There’s uncertainty. But there’s no collective decision yet.

Why the Moonshots Are Still Cheap

Gold bulls love to talk about $6,000, $7,000, even $10,000. The Polymarket ladder doesn’t dismiss those levels — it just refuses to overpay for them.

That’s because time matters.

February is a short window. Parabolic moves in gold usually require something abrupt and undeniable:

-

a monetary shock,

-

a sovereign failure,

-

or a sudden escalation that forces instant repricing.

Absent that, traders treat upside tails as optionality, not destiny. That’s why the extreme highs are priced in the low single digits.

Not impossible. Just not visible yet.

Volume Tells You Where Conviction Lives

The most heavily traded rungs sit around:

-

$4,600

-

$5,500

-

$5,800

That’s where the argument is happening.

Traders aren’t piling into disaster hedges at the bottom.

They’re not aping into moon targets either.

They’re debating how violent the swings will be — not whether gold is about to escape the range.

That’s a very specific kind of consensus.

This Matches How Gold Actually Trades

If you’ve watched gold long enough, this ladder should feel familiar.

Gold loves to:

-

spike intraday,

-

tag levels that feel “too high” or “too low,”

-

then snap back hard.

Prediction markets don’t price comfort. They price touch risk.

A 36–50% chance of printing mid-range levels doesn’t imply confidence. It implies expected turbulence.

Is This Market Efficient? Surprisingly, Yes

There are a few tells:

-

The curve is smooth

-

No single rung is obviously mispriced

-

No panic at the top

-

No fear compression at the bottom

That’s usually what you see when a market is being traded by people who understand the asset, not tourists chasing headlines.

There’s no free lunch visible here. Just a clear expression of uncertainty.

Final Take

This Polymarket ladder isn’t bullish or bearish in the way people want it to be.

It’s saying something more nuanced:

Gold is expected to move — a lot.

But not to break its character in February.

High volatility.

Wide range.

No moon yet.

If that changes, the curve will tell you long before the headlines do.