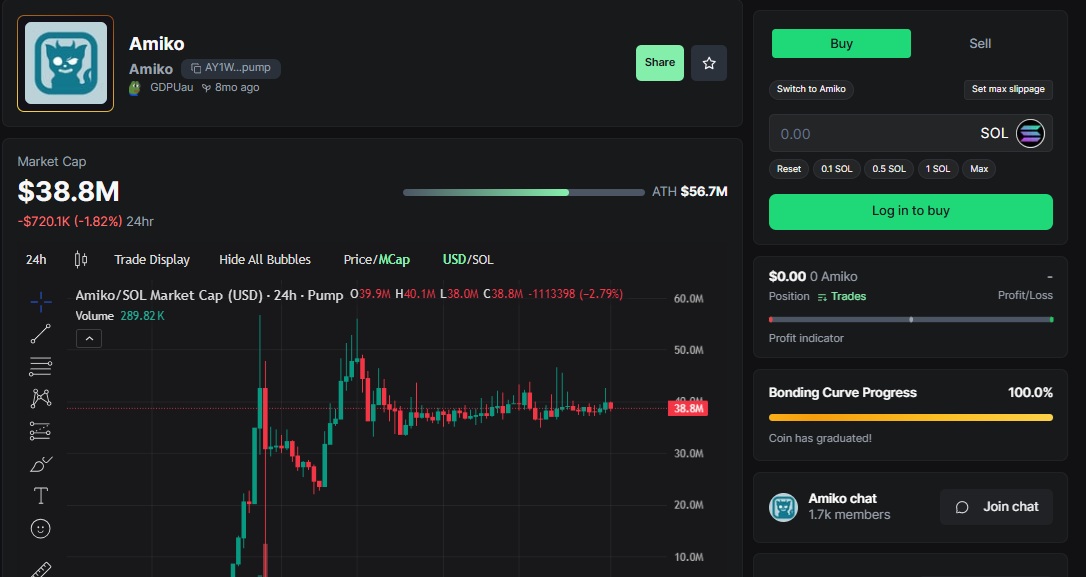

Amiko, a Solana-based memecoin listed on pump.fun, is trading around a $38.8 million market capitalization, consolidating after an earlier surge that lifted the token to an all-time high near $56.7 million. Originally launched and discovered on pump.fun, Amiko has since transitioned from an early-stage pump.fun memecoin into a mid-cap asset that continues to attract attention across the Solana memecoin ecosystem.

The memecoin is down roughly 1.8% over the past 24 hours, with daily trading volume near $300,000, signaling a period of reduced volatility compared with its initial breakout phase. Despite the pullback from highs, Amiko remains one of the more visible pump.fun memecoins to sustain a market cap above $30 million for multiple weeks.

Unlike many memecoins listed on pump.fun that fade quickly once early hype dissipates, Amiko has maintained a relatively stable price range, suggesting that a portion of supply has shifted into longer-term hands. This price behavior places Amiko among a smaller group of pump.fun-origin memecoins that have survived beyond the launch and post-graduation stages.

Deep Structural Analysis: Amiko’s Position in the pump.fun Memecoin Lifecycle

From pump.fun Launch to Mid-Cap Consolidation

As a memecoin launched on pump.fun, Amiko has already cleared the most lethal stages of the pump.fun lifecycle. The majority of memecoins listed on pump.fun fail shortly after graduation, unable to withstand early holder distribution and attention decay. Amiko avoided that outcome months ago, reaching a peak above $50 million before entering its current consolidation phase.

At roughly 8 months old, Amiko now sits in the mid-cycle gravity zone for memecoins. At this stage, price action is no longer driven by novelty or rapid pump.fun rotation, but by sustained interest, liquidity depth, and narrative persistence.

Market Structure and Capital Behavior

Amiko’s chart structure shows a textbook post-expansion pattern:

-

A rapid vertical advance into the $50M–$55M zone

-

A sharp but controlled retracement

-

Prolonged sideways movement between ~$35M and ~$42M

This matters because memecoins that fail structurally tend to collapse back toward single-digit market caps. Amiko’s ability to hold above $30 million suggests that early profit-taking has already occurred without triggering a broader exit cascade.

This behavior is consistent with successful pump.fun memecoins that transition into longer-lived speculative assets rather than short-lived hype trades.

Volume Compression and Attention Risk

Daily volume has declined significantly from peak levels, a natural development as speculative momentum fades. In memecoin markets, falling volume is not automatically bearish; instead, it becomes dangerous only when accompanied by accelerating price declines.

For Amiko, volume compression alongside price stability implies that existing holders are not aggressively exiting. The risk, however, lies in attention rotation. As new memecoins continue to launch on pump.fun, Amiko must compete for relevance in an increasingly crowded Solana memecoin landscape.

Narrative Elasticity

Amiko’s branding leans into an AI-themed companion narrative, which differentiates it from purely abstract or joke-based memecoins. At a ~$40M valuation, however, narrative sustainability becomes more important than novelty. The question is no longer whether the memecoin is interesting, but whether it can remain culturally relevant as broader memecoin themes evolve.

This is a common pressure point for pump.fun memecoins that reach mid-cap territory.

Smart Analysis Summary: What Matters Now for the Amiko Memecoin

Lifecycle phase:

Amiko is firmly in the mid-cycle gravity zone. It has survived pump.fun launch, graduation, and initial distribution, but it has not yet reached full memecoin assetification.

What usually kills memecoins at this stage:

-

Loss of attention as capital rotates to newer pump.fun launches

-

Extended sideways trading that erodes speculative interest

-

Failure to reclaim prior highs with meaningful volume

What would strengthen the survival case:

-

A sustained move back above the $45M–$50M zone

-

Rising volume driven by new wallets rather than internal rotation

-

Renewed narrative traction that differentiates Amiko from newer pump.fun memecoins

Key invalidation level:

A decisive break below the $30M market cap would signal that Amiko is slipping out of the survivor category and entering entropy, a common fate for mid-cap memecoins.

Bottom Line

Amiko remains a notable example of a pump.fun-listed memecoin that successfully transitioned beyond its launch phase. However, at its current size, the challenge is no longer growth by hype, but growth by sustained relevance. For analysts tracking memecoins listed on pump.fun, Amiko offers a clear case study of how a memecoin behaves once it reaches the most difficult phase of its lifecycle.

[…] benefits from deep liquidity and large-scale participation relative to newer memecoins listed on pump.fun, which often struggle to maintain attention beyond […]

[…] early-stage pump.fun memecoins, declining volume often signals imminent failure. For larger memecoins, however, volume compression […]

[…] a pump.fun memecoin graduates, it enters a market regime […]