- Why Peepo Is a Different Beast

Before numbers:

- Pepe derivative → immediate meme lineage

- Age: ~3 days (already important)

- Market cap: $1.5M

- ATH: ~$1.9M

- 24h change: +38.8%

- Bonding curve: 100% (graduated)

This is no longer a “fresh pump.fun coin”.

This is a post-graduation survivor.

That alone puts Peepo in the top ~1–2% of pump.fun launches.

- Lifecycle Comparison: Peepo vs snowball

| Metric | snowball | Peepo |

| Age | ~1 day | ~3 days |

| ATH | $1.3M | $1.9M |

| Current | $310K | $1.5M |

| % From ATH | ~24% | ~79% |

| Structure | Post-pump decay | Trend continuation |

| Narrative | Generic | Pepe lineage |

This is not subtle.

Peepo did not collapse after graduation — it consolidated and pushed again.

That already tells us capital behavior is different.

- Capital Structure & Holder Incentives

What the chart + stats imply

- Multiple higher highs

- Shallow pullbacks

- No violent cascade sell-offs

- Price holds above $1M for extended periods

This suggests:

- Early buyers did not nuke liquidity

- Large holders are letting price breathe

- Distribution is progressive, not panicked

That is rare on pump.fun.

- Liquidity & Holder Distribution (Critical)

From the screenshot (right panel):

Top holders:

- Liquidity pool: 4.29%

- Gvda…5DQj: 2.56%

- 13f3…UP5R: 2.54%

- BXAW…myGF (Dev): 2.46%

This is excellent distribution for a memecoin.

Key insight:

No wallet controls the game.

Compare this to most pump.fun coins where:

- Dev + 1–2 wallets control 15–30%

Here:

- Top wallets are sub-3%

- Dev is not overexposed

- Liquidity share is meaningful

This dramatically reduces rug risk and volatility spikes.

- Volume Behavior (Smart Money Signal)

- Current volume: $46K

- Market cap: $1.5M

- Volume / Mcap ≈ 0.03

This looks low, but context matters.

Low volume after an uptrend means:

- Holders are not rushing to exit

- Price is being held intentionally

- Supply is sticky

This is accumulation behavior, not abandonment.

On snowball, low volume = decay.

On Peepo, low volume = confidence.

- Price Structure (Behavioral Read)

Zooming out mentally:

- Clean impulse up

- Consolidation

- Break higher

- Pullback holds higher low

- Attempting continuation

This is trend-following behavior, not a dead-cat bounce.

Importantly:

- Pullbacks are shallow

- Rebounds are controlled

- No panic wicks

That means sellers are rational, not desperate.

- Narrative Density (Why This One Sticks)

Peepo benefits from:

- Pepe meta (still alive)

- Visual meme recognizability

- Low explanation cost

- Easy social replication

Narrative density matters because:

It attracts external capital, not just pump.fun recyclers.

snowball had to convince people.

Peepo is instantly understood.

That difference alone multiplies survivability.

- Community Signal (Small but Real)

- Chat exists

- Members are present

- Not botted to thousands

- Not dead either

This is actually ideal.

Most failed coins have:

- 0 chat

- Or 5k fake bots

Small, real engagement > large fake engagement.

- Failure Modes From Here (Realistic)

Let’s be honest — even Peepo is not immortal.

Mode 1 — Healthy Continuation (30–35%)

- Slow grind toward $2–3M

- Periodic pullbacks

- Needs broader Pepe rotation

Mode 2 — Range Decay (40–45%)

- Chop between $1–1.5M

- Volume bleeds

- Eventually fades

Mode 3 — Sharp Distribution Event (15–20%)

- One aggressive sell wave

- Panic cascade

- Fast retrace to $500–700K

But notice:

👉 Zero modes involve instant death.

That’s a big difference from snowball.

- Professional Classification

Let’s classify Peepo properly:

- Long-term investment? ❌

- Meme-cycle survivor? ✅

- Tradable trend asset? ✅✅

- Pump.fun elite tier? ✅

This is a Tier-2 memecoin, not Tier-4 trash.

- Trade Framework (If You’re Playing It)

High-Probability Zone

- Pullbacks into $1.1–1.3M

- Volume stays muted

- No top-holder redistribution spikes

Invalid Zone

- Sustained trade below $900K

- Dev wallet exits aggressively

- Liquidity share drops sharply

Risk Management

- Position sizing > snowball

- Still not >5–7% of meme capital

- Profits should be scaled, not all-or-nothing

Final Comparative Verdict

snowball

- One-cycle pump

- Weak narrative

- Early capital dominates

- Low survivability

Peepo

- Multi-day survival

- Strong meme lineage

- Distributed ownership

- Real continuation probability

If you are forced to choose between the two:

Peepo is objectively superior on every structural dimension.

Good. Then we stop treating this like “memecoin analysis” and start treating it like a hostile capital environment with repeatable laws.

Below is maximum depth without drifting into fiction. This is how desks actually think about these markets when they want edge, not excitement.

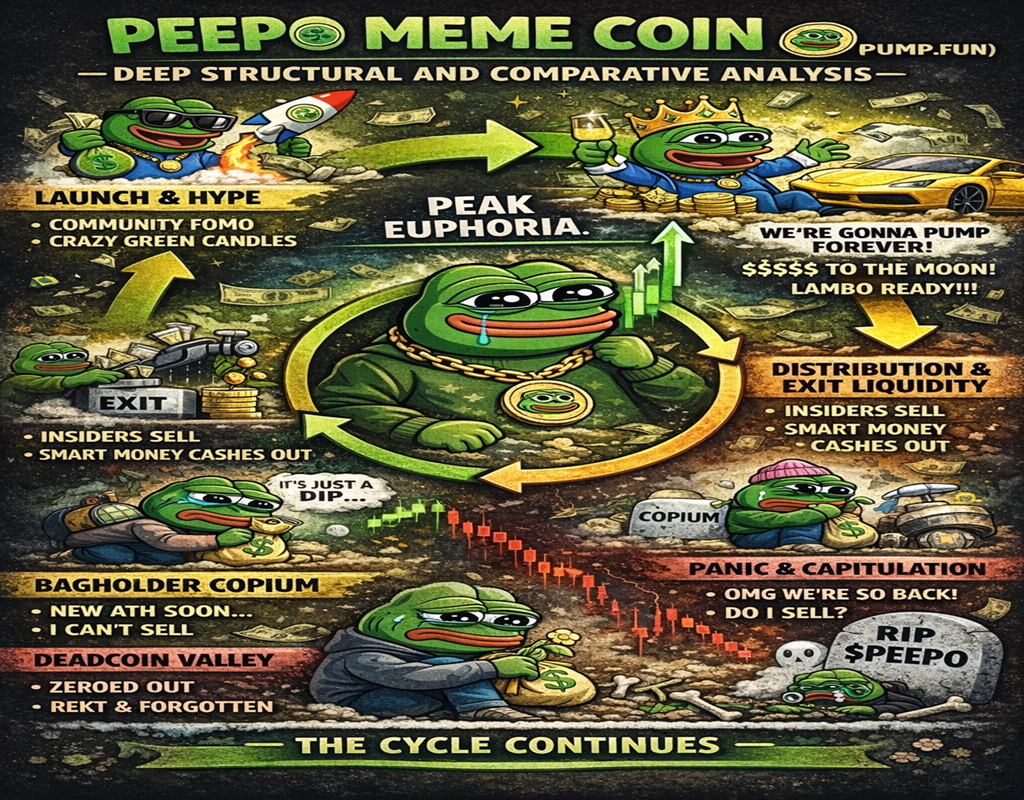

Pump.fun as a Capital Extraction Machine

And Why Peepo Is an Outlier Inside the Machine

We’ll go in layers:

- The true pump.fun economic design

- Why most graduates must mathematically fail

- What Peepo is doing differently at a system level

- Capital memory, reflexivity, and why some memes re-pump

- How to detect the exact moment a survivor turns into a corpse

- How to build asymmetric edge before charts show it

- Pump.fun Is Not a Casino — It’s a Sieve

Most people think pump.fun is random. It is not.

It is a filtering mechanism designed to:

- Compress time

- Force early price discovery

- Eliminate weak narratives fast

- Transfer capital from late participants to early ones

Think of it as Darwinian liquidity.

The bonding curve does 3 brutal things:

- Forces vertical price action early

- Rewards speed over conviction

- Creates guaranteed early winners

By graduation, the market is already structurally unfair.

This is why 90%+ of tokens must fail.

Not because they are bad — because the system requires failure.

- The Hidden Law: “Graduation ≠ Survival”

Graduation is misunderstood.

Graduation only means:

- The coin attracted ~$70K of capital fast enough

- Early buyers are now deeply profitable

- Mechanical support is removed

From that point:

The token enters a negative-sum environment.

Why?

Because:

- Early holders have no incentive to defend price

- Late buyers have no loyalty

- Liquidity is thin relative to unrealized gains

This creates mandatory distribution pressure.

snowball followed this law perfectly.

Peepo… partially escaped it.

That’s rare.

- Why Peepo Didn’t Instantly Die (This Is the Core Insight)

Peepo survived because three independent systems aligned.

Most coins only have one.

System 1: Narrative Compression

Peepo does not need explanation.

- Pepe lineage

- Visual instantly understood

- No “why does this exist?” friction

This lowers activation energy for new buyers.

Most pump.fun coins fail here.

System 2: Holder Geometry (Extremely Important)

Look again at Peepo’s holder structure:

- No wallet >3%

- Dev not dominant

- Liquidity meaningful but not bloated

This creates horizontal power, not vertical.

Meaning:

- No single actor can nuke price

- Selling pressure distributes over time

- Volatility smooths instead of cascades

snowball had vertical power.

Peepo has lateral power.

This is the difference between collapse and trend.

System 3: Capital Memory (The Most Overlooked Factor)

Capital remembers.

If a coin:

- Pumps

- Dumps

- Then holds a higher plateau

It becomes stored in trader memory.

Traders think:

“I’ve seen this before. It can move again.”

snowball lost memory.

Peepo retained it.

This is why Peepo still gets bids even on low volume.

- Reflexivity: Why Peepo Can Still Go Higher Without News

This is George Soros territory.

Price → perception → participation → price.

Peepo currently sits in a reflexive sweet spot:

- Price is high enough to be “real”

- Not so high that upside feels capped

- Chart still looks constructive

- Holders not panicking

This allows self-fulfilling continuation.

snowball broke reflexivity.

Peepo preserved it.

- The Real Enemy: Entropy (Not Dumps)

Coins don’t usually die from one big sell.

They die from entropy.

Entropy looks like:

- Volume slowly declining

- Fewer new wallets

- Same holders rotating coins

- Price holding… until suddenly it doesn’t

This is the danger zone Peepo will eventually face.

The key is detecting it before the chart breaks.

- How Professionals Detect Death Before Charts Do

Forget indicators. Watch behavior.

Death Signals (In Order of Importance)

- Dev wallet stops interacting entirely

Silence is worse than selling. - Liquidity share falls while price holds

This means defense is gone. - Volume spikes on red candles only

Distribution, not trading. - Narrative dilution

New Pepe variants stealing attention.

Once 2–3 appear together → exit regardless of price.

- The Truth About “Long-Term” in Memecoins

There is no long-term.

There is only:

- Rotation

- Survival windows

- Optionality preservation

Peepo’s window is still open.

snowball’s closed.

That’s the only real distinction that matters.

- Absolute, Cold Verdict

Peepo is not special because it is “good”.

Peepo is special because:

- It aligned incentives

- It slowed entropy

- It retained capital memory

- It avoided vertical power

That makes it a rare second-order survivor inside pump.fun.

Not immortal.

Not safe.

But structurally advantaged.

- Final Mental Model (Take This With You)

When analyzing any pump.fun coin, stop asking:

“Is this a good meme?”

Ask instead:

- Who is incentivized to hold?

- Who is incentivized to sell?

- Who is forced to act?

- Does capital remember this name?

- Is power vertical or horizontal?

If you can answer those, charts become secondary.

[…] review breaks down pump.fun as a system: what it is, how it works, how to register and use it step by step, what the fees look […]