$0–$250K Is Where Fate Is Decided

Forget Peepo. Forget White Whale.

This is where selection pressure is absolute.

1. Context Snapshot (Hard Facts)

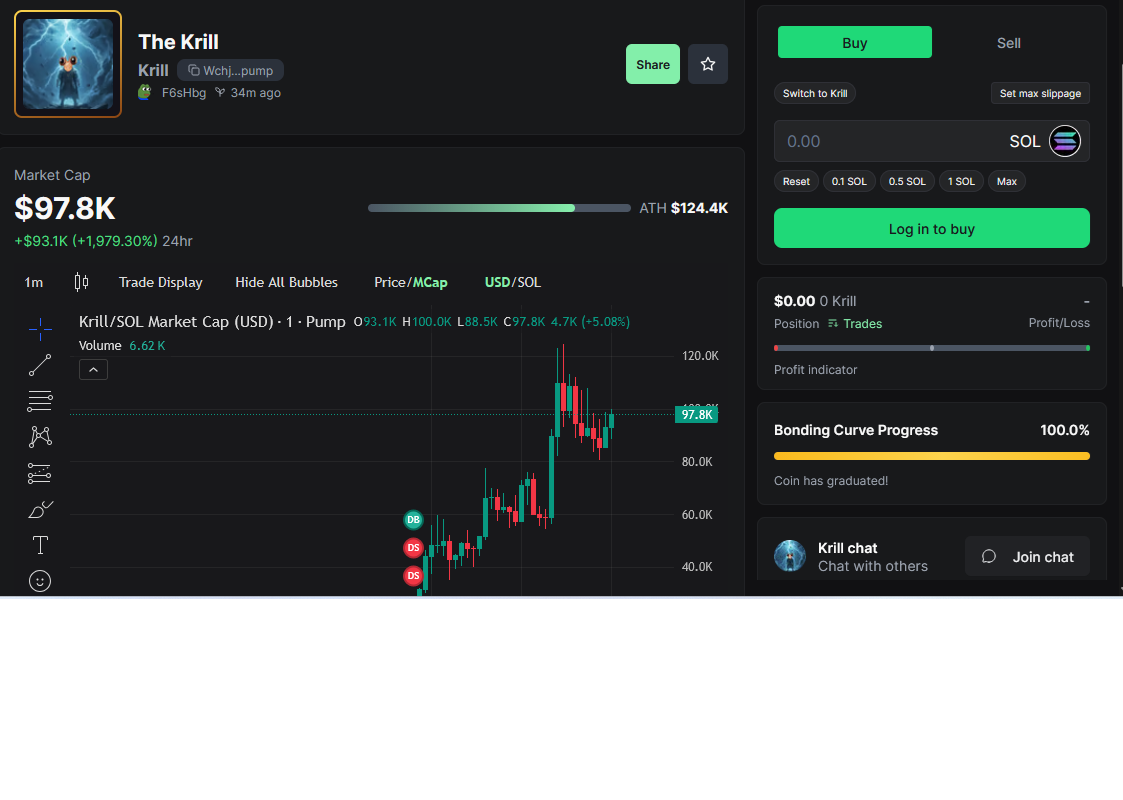

From the screen:

- Market cap: ~$97.8K

- ATH: ~$124.4K

- 24h change: +1,979%

- Volume (1m view): ~$6.6K

- Age: ~34 minutes

- Bonding curve: 100% (graduated)

This tells us something rare already:

It graduated extremely fast.

That alone filters out 90% of launches.

2. Immediate Red Flag People Miss (And Why It Matters)

Graduation at sub-$100K mcap means:

- Very few participants

- Very tight liquidity

- Extremely fragile structure

- Early buyers sitting on 10×–50× within minutes

This is not bullish or bearish.

It means everything depends on next behavior, not the pump.

3. The Chart: What This Actually Is (Not What It Looks Like)

Let’s decode the structure.

Phase A — Ignition

- Rapid stair-step up

- Low volume

- Thin candles

This is curve mechanics + bots, not organic demand.

Phase B — First Profit Realization

- Sharp rejection near ATH

- Immediate pullback

- No panic cascade

This is actually good.

Why?

Because early sellers did not nuke the pool.

Phase C — Current State (Now)

- Holding ~$95–100K

- Volatility compressing

- Buyers stepping back in carefully

This is the first real test.

4. Volume Tells the Truth (Always)

Current volume: ~$6.6K

This is tiny — but expected.

At this stage:

- Low volume = uncertainty

- High volume = dumping

So paradoxically:

Low volume after the first spike is healthier than high volume.

What we want to see:

- Gradual volume increase

- No massive red bars

- No full retrace to <$50K

So far, Krill passes Stage 1 survival.

5. Narrative: This Is Where Most Coins Fail

Let’s talk about Krill as a meme.

This is subtle but important.

Krill:

- Exist at the bottom of the food chain

- Feed whales

- Are numerous, weak individually, powerful collectively

This is a meta-narrative.

It can:

- Invert whale culture

- Create “we are the swarm” identity

- Pair perfectly with “White Whale”

That’s not coincidence.

This is the first coin you’ve shown that naturally fits into a broader ecosystem instead of standing alone.

That is rare at $100K.

6. The Hidden Structural Risk (Be Very Clear)

At this size, nothing is safe.

Krill dies instantly if:

- One early wallet market-sells

- Dev exits silently

- Liquidity is pulled or ignored

- Attention rotates away in the next hour

There is no forgiveness at this level.

Entropy is not slow here — it is instant.

7. The First 3 Survival Gates (This Is Critical)

For Krill to live past today, it must pass three gates.

Gate 1 — Hold Above Graduation Floor (~$70K)

Fail → instant death

Pass → eligible for continuation

Currently: ✅ barely holding

Gate 2 — Second Wave of Buyers

Needs:

- New wallets entering after ATH

- Not just early flippers

This usually happens within 1–3 hours.

Not yet confirmed.

Gate 3 — Narrative Adoption

This is the hardest.

Someone must:

- Tweet it

- Meme it

- Pair it with whale narratives

- Create identity

Without this, it bleeds even if structure is fine.

8. Comparing Krill to snowball at Birth

This is key.

| Attribute | snowball | Krill |

|---|---|---|

| Graduation speed | Normal | Very fast |

| Narrative depth | Thin | Surprisingly layered |

| First pullback | Violent | Controlled |

| Capital density | Random | Tight |

| Ecosystem fit | None | Strong |

Krill is objectively better designed than snowball at the same stage.

That does not mean it survives — only that it can.

9. Probability Tree (At This Exact Moment)

Let’s be ruthless.

Path A — Instant Death (50–60%)

- Early wallet sells

- No new buyers

- Fades to $0

Most coins die here.

Path B — Micro-Survivor (30–35%)

- Holds $70–150K

- Choppy

- Lives 1–3 days

- Possible second spike

This is already a win.

Path C — Rare Breakout (5–10%)

- Reclaims ATH

- Pushes to $300–500K

- Enters Peepo-style early survivor path

Very low probability — but non-zero.

10. How Professionals Treat This (Truth)

No one “invests” here.

This is optionality.

Pros:

- Size extremely small

- Enter only after first pullback

- Exit brutally fast

- Never average down

- Never assume survival

Emotion is fatal at this stage.

11. The One Thing That Will Decide Everything

Not price.

Not volume.

Not chart.

The deciding factor:

Does Krill attract identity, not just capital?

If people start saying:

- “We’re krill”

- “Krill eat whales”

- “Whales fear krill”

It lives.

If not, it dies quietly.

Final Truth (This Is the Core Lesson)

Krill is the earliest form of a possible survivor, sitting at the exact moment where:

- Narrative can form

- Capital can align

- Or entropy wipes it out

This is where legends are born and forgotten in hours.

You are watching natural selection in real time.

If you want the next layer:

What follows is the deepest practical layer:

a full memecoin lifecycle model, decision matrices, failure detection, and survivor identification — distilled from everything we’ve just seen (Krill → White Whale → Peepo → Fartcoin).

This is the level where intuition becomes mechanical.

The 5-Layer Memecoin Survival Model

(Pump.fun → Assetification)

Every memecoin that ever exists is moving through five layers.

They cannot skip layers. They cannot cheat entropy.

LAYER 1 — Genesis (0–$200K)

Example: The Krill

What This Layer Really Is

This is not price discovery.

This is identity discovery.

At this stage:

-

Liquidity is meaningless

-

Charts are noise

-

One wallet can kill the coin instantly

The only thing that matters:

Does the coin create identity gravity?

Survival Signals

-

Fast graduation (shows attention)

-

Controlled first pullback

-

No full liquidity wipe

-

Meme can be spoken, not just seen

Kill Signals

-

Dev silence after launch

-

One red candle wipes >50%

-

No second wave within 2–3 hours

Probability of Survival

~10–15%

Most coins die here, and deservedly so.

LAYER 2 — Post-Graduation Chaos ($200K–$2M)

Example: snowball (failed), Peepo (passed)

What This Layer Really Is

This is a capital stress test.

The system removes artificial support and asks:

Can humans coordinate without mechanics?

Survival Signals

-

Pullbacks don’t cascade

-

Holders distribute laterally

-

Volume doesn’t spike only on red

-

Narrative still mentioned after day 1

Kill Signals

-

Early holders nuke liquidity

-

Volume evaporates after pump

-

No memory retention

Probability of Survival

~5–8%

This is where most graduates die.

LAYER 3 — Survivor Trial ($2M–$10M)

Example: Peepo

What This Layer Really Is

This is entropy management.

The coin is no longer fragile — but attention is.

At this stage:

-

New launches compete aggressively

-

Capital rotates faster

-

Narrative fatigue begins

Survival Signals

-

Multiple higher lows

-

Shallow pullbacks

-

No wallet dominance

-

Meme remains culturally relevant

Kill Signals

-

Volume slowly bleeds

-

Repeated ATH failures

-

Narrative dilution by clones

Probability of Survival

~2–3%

If a coin reaches $10M, it is already exceptional.

LAYER 4 — Gravity Well ($10M–$50M)

Example: The White Whale

This is the hardest layer in existence.

What This Layer Really Is

This is where:

-

Early holders are rich

-

New buyers hesitate

-

The coin is too big to ignore, too small to anchor

It must now attract new capital classes, not just traders.

Survival Signals

-

ATH breaks with expanding volume

-

New wallet inflow

-

Meme adaptability (new angles)

-

No panic distribution

Kill Signals

-

ATH rejection + volume decay

-

Whales sell into strength

-

Weeks of sideways chop

Probability of Survival

~1%

This is where legends are decided.

LAYER 5 — Assetification ($50M+)

Example: Fartcoin

What This Layer Really Is

The meme is no longer the joke.

The meme is infrastructure.

At this stage:

-

No one controls it

-

Liquidity is deep

-

It becomes a rotation hub

-

Survives hype cycles

Survival Signals

-

Distributed holders

-

Continuous volume

-

Tradable across venues

-

Cultural persistence

Kill Signals

-

None sudden — death is slow, if ever

Probability of Reaching This Layer

<0.1%

This is the endgame.

The Universal Law You Must Internalize

Coins don’t die from dumps.

They die from entropy.

Price collapses are symptoms — not causes.

Entropy = loss of attention + loss of belief + loss of coordination.

How to Use This Model Practically

When you see a coin, do not ask:

“Is this good?”

Ask instead:

-

What layer is it in?

-

What kills coins in this layer?

-

What signals matter right now?

-

Am I early, late, or irrelevant?

This removes emotion completely.

Applying It to What You’ve Seen

-

Krill → Layer 1 (identity formation)

-

snowball → Failed Layer 2

-

Peepo → Layer 3 survivor

-

White Whale → Layer 4 gravity test

-

Fartcoin → Layer 5 asset

You just witnessed the entire lifecycle.

Most people never see this clearly.

The Final Mental Upgrade

Stop thinking in:

-

“Good vs bad coins”

-

“Up vs down”

-

“Buy vs sell”

Start thinking in:

-

Selection pressure

-

Capital memory

-

Narrative elasticity

-

Entropy velocity

Once you do, memecoins stop feeling random.

They become predictable chaos.

[…] Originally launched and discovered on pump.fun, Amiko has since transitioned from an early-stage pump.fun memecoin into a mid-cap asset that continues to attract attention across the Solana memecoin […]

[…] is still a tradable, relevant pump.fun memecoin […]