Why Are Traders Using Polymarket to Price the Next Fed Chair?

Prediction markets have evolved into real-time instruments for pricing political and macroeconomic expectations. Platforms like Polymarket increasingly function as forward-looking sentiment gauges, translating uncertainty into probabilities backed by capital rather than commentary. One of the most actively traded macro-political contracts on Polymarket right now asks a deceptively simple question: who will Donald Trump nominate as Chair of the Federal Reserve if he returns to the White House?

The contract has already attracted nearly $69 million in total volume, making it one of Polymarket’s deepest long-horizon markets. It resolves only if Trump, acting as President of the United States, formally submits a nomination for Federal Reserve Chair to the US Senate by December 31, 2026. Acting or interim appointments do not qualify. That specificity has turned the market into a focused wager on institutional behavior rather than short-term political noise.

Despite the long timeline, traders are expressing a surprisingly tight consensus. The probability distribution offers insight not just into individual candidates, but into how markets are thinking about Trump’s likely approach to monetary policy, institutional leverage, and political signaling in a second term.

Investor Takeaway

What Is the Market Pricing Right Now?

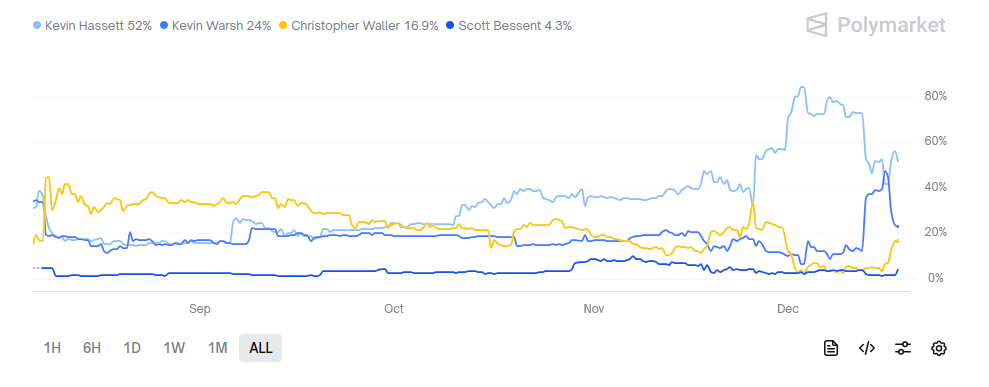

At current levels, Kevin Hassett is the clear market favorite, trading at 52%. His implied probability is higher than all other candidates combined. Kevin Warsh follows at 24%, Christopher Waller at 16.8%, and Scott Bessent at 4.5%. Every other name on the board trades below 3%, with many effectively priced as tail risks.

This distribution suggests that traders believe Trump’s eventual nominee will emerge from a narrow pool of candidates who satisfy three overlapping criteria: personal trust with Trump, perceived credibility with financial markets, and some degree of skepticism toward the modern Federal Reserve framework.

Importantly, this is not a meme-driven market. Volume concentration is heavy at the top, and the long tail appears more like hedging or optionality than genuine conviction. That structure indicates that participants are treating this as a serious institutional forecast rather than a speculative novelty.

Investor Takeaway

Why Does Kevin Hassett Dominate the Odds?

Kevin Hassett’s lead reflects a blend of political familiarity and institutional plausibility. He previously served as Chair of the Council of Economic Advisers during Trump’s first term and has remained a consistent public defender of Trump-era economic policies. That history gives him both personal proximity and ideological alignment.

From a market perspective, Hassett represents a controlled deviation from the current Federal Reserve regime rather than a disruptive break. He has criticized aspects of inflation forecasting and monetary policy decision-making, but he has also shown respect for institutional processes and credibility constraints.

This balance likely explains why traders have been willing to concentrate so much probability on his candidacy. With roughly $4.1 million in volume tied directly to Hassett, the market appears to be treating him as the base case rather than a speculative favorite.

Investor Takeaway

Kevin Warsh: The Ideological Reset Scenario

Kevin Warsh, trading at 24%, represents the main alternative path. A former Federal Reserve governor, Warsh has been openly critical of quantitative easing, balance sheet expansion, and what he views as excessive political entanglement in monetary policy.

His appeal to Trump would be ideological clarity. Warsh is widely seen as someone willing to challenge the post-2008 monetary consensus more aggressively than Hassett. That stance aligns with Trump’s historical criticism of the Federal Reserve, particularly during tightening cycles.

However, that same clarity introduces friction. Senate confirmation could be more contentious, and bond markets might react more negatively to a nominee perceived as destabilizing established frameworks. The market appears to be pricing this tradeoff explicitly by capping Warsh’s odds well below Hassett’s.

Investor Takeaway

Christopher Waller and the Continuity Option

Christopher Waller, a sitting Federal Reserve Governor, trades at 16.8%. His presence introduces a third scenario: institutional continuity paired with political authority.

Waller’s academic background and current role within the Fed system make him operationally less disruptive. A nomination would signal restraint, reduce confirmation risk, and likely minimize immediate market volatility.

However, his ideological alignment with Trump is weaker than that of Hassett or Warsh. As a result, markets appear to treat Waller as a compromise outcome rather than a primary objective.

Investor Takeaway

Why Are Most Other Names Priced as Noise?

Beyond the top four candidates, probabilities fall sharply. Figures such as Judy Shelton, David Malpass, Michelle Bowman, and even Jerome Powell all trade below 3%.

Some of these positions reflect residual narratives from Trump’s first term, while others appear to function as hedges against unlikely political pivots. The low pricing suggests traders believe institutional constraints that blocked certain nominees in the past remain firmly in place.

Notably, overtly symbolic or meme-adjacent outcomes are priced near zero. This reinforces the view that Polymarket participants are approaching this contract with institutional realism rather than speculative imagination.

Investor Takeaway

What Events Could Move This Market Meaningfully?

Because resolution is tied to a formal Senate nomination, probabilities are likely to remain fluid. However, several catalysts could meaningfully shift pricing:

- Direct public endorsements or signaling from Trump or close advisers

- Changes in Senate composition that alter confirmation dynamics

- Macroeconomic stress, such as renewed inflation or recession risk

- Explicit Trump speeches targeting Fed policy frameworks

Historically, prediction markets tend to overreact to rhetorical signals early, then converge toward institutional feasibility as resolution approaches. This market is likely to follow a similar path.

Investor Takeaway

What Is the Market Really Saying About a Second Trump Term?

At a deeper level, this contract is not just about personalities. It is a wager on how disruptive a second Trump presidency would be to monetary governance.

The heavy concentration around Hassett suggests that traders expect Trump to seek influence and loyalty without triggering systemic instability. Warsh and Waller represent alternative expressions of that influence, one ideological and one technocratic. The rest of the field is effectively dismissed.

In hype-economics terms, this is a market pricing moderation rather than rupture.

Investor Takeaway

Bottom Line: Polymarket’s Fed Chair Base Case

As it stands, Polymarket is pricing a Trump Fed Chair nomination as more evolutionary than revolutionary. Kevin Hassett’s lead reflects a belief that Trump would prioritize loyalty and policy alignment while still respecting confirmation dynamics and market stability.

That consensus could shift quickly if political signals change. But for now, the market’s message is clear: traders expect a familiar, institutionally credible figure to emerge — not a shock appointment.

[…] is not trading in a neutral market. It is operating inside a designed economic game with fixed incentives and predictable […]

[…] Memecoin narratives decay fast. A token that is “hot” for 2 hours can be dead by dinner. Unless the meme escapes the platform into broader distribution (X, Telegram, influencers, or viral media), it often cannot sustain demand. […]

[…] yield through staking, locking that ETH as stablecoin collateral carries an opportunity cost. Stablecoin holders implicitly forgo staking rewards, making the stablecoin less attractive unless it offers […]